![6 Types of Informational Content that Thomas Cook is Missing [Untapped Potential Issue #3]](https://digitaloft.co.uk/wp-content/uploads/2024/05/tc.png)

This deep dive is part of our Untapped Potential newsletter, where we reveal the SEO tactics we’d deploy to unleash the untapped potential of a different brand every week. Sign up to get more content just like this straight into your inbox every Wednesday.

Thomas Cook, a British online travel agent (OTA) and former chain of high street travel agents (before the brand’s collapse in 2019, later to be relaunched by the Fosun Tourism Group, which also owns Club Med), has had a turbulent few years on the SERPs.

The site enjoys upwards of two million monthly sessions in the UK from organic search, but this is just a fraction of the seven million seen back in 2018.

How much of this traffic could the brand recover, I wonder?

We can see from the chart below that organic visibility has been on a slow but steady increase in 2023, but a brand with such a long history as one of the UK’s leading travel agents should be in a position to drive growth faster than this.

And in this deep dive, I want to take a look at how Thomas Cook can leverage what I call ‘keyword patterns’ to reach potential holidaymakers much earlier on in their booking journey.

Keyword patterns are all about finding trends during keyword research, which can be scaled by switching out a variable. Often, for travel brands, this is a destination.

I want to shine a light on six different types of informational content that the Thomas Cook site has completely overlooked and that, if worked into the brand’s content strategy, could help to create a step-up in visibility higher up the funnel, as well as working to support the rankings of main commercial terms.

But there’s a reason why I’m only looking at informational content here. And it’s a strategic one.

Hear me out…

Google absolutely slammed travel blogs over the last few Helpful Content Updates.

And whilst I don’t agree with the level of drops that many smaller publishers have seen over the last two years, it is what it is. There have still been no reported recoveries from the HCU, and it doesn’t look likely that we’ll see any anytime soon.

This means there’s an opportunity for brands like Thomas Cook to double down on producing informational content. Essentially, the competition that existed on the SERPs from travel blogs and smaller publications has massively reduced. And, as far as I’m concerned, it’s the perfect opportunity for brands to take advantage of this and take the spot these niche sites once held.

We know that Google continues to make shifts to send searchers straight to the sites where they can buy (or book, in this case) rather than affiliates and review sites. And brands like Thomas Cook, who allow searchers to book directly on the site, are perfectly placed to win big with the right strategy.

And when you realise that competitors such as TUI are ranking for a lot of these queries with (sorry for saying) pretty mediocre content, the opportunity becomes even more exciting (more on this below).

If I was running Thomas Cook’s SEO strategy, I’d be investing big into informational content. It’s a chance to increase visibility at the top and middle of the funnel, creating an opportunity not just to steer traffic towards resorts, packages and other offers, but also to retarget with paid media and integrate with other channels, too.

Thomas Cook: A Quick Background

Don’t know who Thomas Cook is? Here’s a quick background to give you the context you need to know about the brand.

- Founded in 1841 by Thomas Cook, a British businessman, who organised his first excursion, a rail journey from Leicester to Loughborough. This marked the start of the world’s first travel agency.

- Throughout the 19th and early 20th centuries, Thomas Cook expanded its services from simple train excursions to include international travel, guided tours, and the introduction of traveller’s cheques.

- By the mid-20th century, Thomas Cook had established a global presence, offering travel and tour packages around the world. Its services included holiday packages, flights, cruises, and hotel bookings.

- Thomas Cook faced financial difficulties in the 21st century, culminating in its collapse in September 2019. The company struggled with high levels of debt, fierce competition, and changing consumer habits.

- Thomas Cook is credited with inventing the modern concept of package holidays and making travel accessible to a broader segment of the population. Its legacy continues to influence the travel industry today.

Accelerating SEO Success: Thomas Cook’s Biggest Content Gaps

Content forms the cornerstone of pretty much any successful SEO strategy, but informational content has differing levels of influence over purchasing decisions from niche to niche.

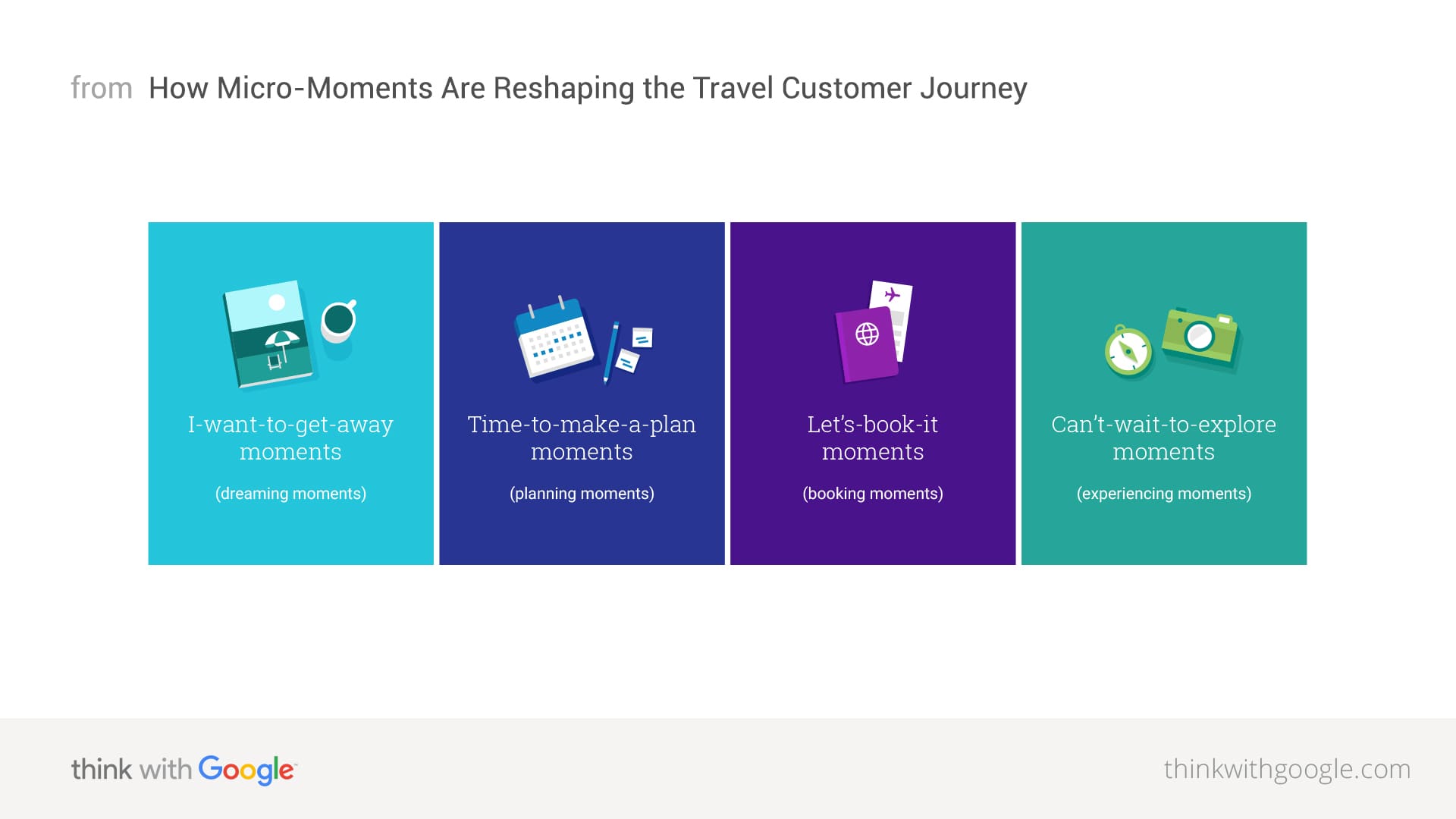

For travel, however, informational content should sit at the very heart of every successful content strategy, largely due to the journey which travellers take before and after making a booking.

Travel can be broken down into four micro-moments:

- Dreaming Moments

- Planning Moment

- Booking Moments

- Experiencing Moments

From being visible when people are searching for inspiration on where to go for their next holiday to planning, booking, and researching things to do, there’s no getting away from the importance of content and making sure that this ranks on the SERPs.

Thomas Cook’s overall organic visibility is a shadow of its former self, but with the right strategy in place, 2024 could see rapid growth.

After all, brand plays a key role in ranking on the SERPs right now, and there’s no denying Thomas Cook’s brand history.

That said, the only way to guarantee not ranking for a keyword is to not have content that aligns with the query or its intent.

And closing many of the existing content gaps are a surefire way to drive growth.

We can see from rankings such as “package holidays” in #2 and “holidays” in #3 that the site has the ability to rank. And I’d expect the content types I’m about to recommend to rank prominently once they’re launched.

These recommendations aren’t the only content gap opportunities that exist. I identified these opportunities whilst analysing the site, all discovered without access to first-party data from Google Analytics or Google Search Console.

Let’s look at six types of informational content missing from Thomas Cook’s SEO strategy.

1. The Best Holiday Destinations in [Month]

There are thousands of people every month searching for recommendations on where to holiday in a specific month of the year.

And right now, Thomas Cook isn’t ranking for any of these keywords. At least, not with content that matches the intent.

Here’s how the opportunity sizes up:

| Title | Main Keyword | MSV | Rank |

|---|---|---|---|

| The Best Holiday Destinations in January | Best Holiday Destinations in January | 1,300 | 100+ |

| The Best Holiday Destinations in February | Best Holiday Destinations in February | 1,300 | 86 |

| The Best Holiday Destinations in March | Best Holiday Destinations in March | 880 | 100+ |

| The Best Holiday Destinations in April | Best Holiday Destinations in April | 1,600 | 10 (wrong intent) |

| The Best Holiday Destinations in May | Best Holiday Destinations in May | 1,000 | 100+ |

| The Best Holiday Destinations in June | Best Holiday Destinations in June | 720 | 100+ |

| The Best Holiday Destinations in July | Best Holiday Destinations in July | 590 | 100+ |

| The Best Holiday Destinations in August | Best Holiday Destinations in August | 590 | 100+ |

| The Best Holiday Destinations in September | Best Holiday Destinations in September | 1,600 | 100+ |

| The Best Holiday Destinations in October | Best Holiday Destinations in October | 2,900 | 21 (wrong intent) |

| The Best Holiday Destinations in November | Best Holiday Destinations in November | 1,600 | 100+ |

| The Best Holiday Destinations in December | Best Holiday Destinations in December | 880 | 100+ |

We can see that Thomas Cook is ranked in position 10 for “Best Holiday Destinations in April” at the moment, but it’s this page that’s ranking:

In contrast, CN Traveler ranks #1 with a guide titled “The 25 best holiday destinations in April – Where to go in April whether you want safari, sunshine or skiing.”

Here’s one recommendation from that guide:

Thomas Cook’s guide to “Where’s Hot in April” is punching above its weight right now. Yes, it’s ranking in position 10 at the moment, but it doesn’t properly match the intent.

After all, holidays aren’t just about the hot spots. And that guide is really just a temperature roundup.

And this is what makes this type of content an untapped opportunity.

Thomas Cook should go ahead and create detailed guides to the best destinations for each month, breaking these down into recommendations for different types of holidaymakers.

When it’s ski season in one part of the world, it’s the hot season in another. Offering holiday hotspots each month for different holiday types and groups helps to match the intent.

These are 12 top-of-the-funnel pieces of content that should form part of the site’s content strategy, helping to inspire visitors’ next destination choice.

After all, if a brand is able to get in front of potential holidaymakers when they’re at the stage of considering their next destination, this opens up opportunities to target that individual with a multi-channel approach to turn that inspiration into a booking.

Travel SEO is rarely about turning an initial visit into a booking; it’s a much more considered purchase than that. So being able to capture visibility at as many stages of the funnel as possible is more a necessity than a nice-to-have in travel.

But this is also why it’s so important to get internal linking and CTAs right. Don’t just create content that suggests these destinations, make sure it’s easy for a user to see their options from what you offer.

2. [X] of the Best Resorts in [Destination]

When a searcher is looking for recommendations on the best resorts in any given destination, they’ve likely made a shortlist of where they want to go. And they’re now looking for recommendations on resorts within these.

And Thomas Cook has a real big opportunity here.

We know from analysing the impact of the Helpful Content Update on travel publishers that many of the queries that they previously ranked for were roundups just like this; listicles of the best resorts or hotels in different destinations.

But with a lot of these now having lost upwards of 90% of their visibility, there’s an opportunity for travel agencies, like Thomas Cook, to take their place.

You see, a lot of these sites were hit due to a lack of E-E-A-T; particularly the experience part of this. Do you really deserve to rank a piece of content rounding up the best resorts in a destination if you’ve never visited it? I’d say not…

Thomas Cook isn’t an informational site, and certainly has that reputation to be in a position to be advising travellers on the best places to stay.

When someone adds ‘best’ into their search query, it’s easy to understand the intent they have. They want to receive recommendations; they don’t just want to be served a list of resorts. And this is why this type of query remains informational in terms of the results it returns on the SERPs.

But before I look at what’s ranking right now, take a look at the scale of the opportunity:

| Title | Main Keyword | MSV | Rank |

|---|---|---|---|

| [X] of the Best Resorts in Turkey | Best Resorts in Turkey | 2,400 | 100+ |

| [X] of the Best Resorts in Maldives | Best Resorts in Maldives | 1,900 | 100+ |

| [X] of the Best Resorts in Majorca | Best Resorts in Majorca | 1,600 | 60 (wrong intent) |

| [X] of the Best Resorts in Gran Canaria | Best Resorts in Gran Canaria | 1,300 | 75 (wrong intent) |

| [X] of the Best Resorts in Crete | Best Resorts in Crete | 1,300 | 100+ |

| [X] of the Best Resorts in Corfu | Best Resorts in Corfu | 1,000 | 100+ |

| [X] of the Best Resorts in Greece | Best Resorts in Greece | 1,000 | 100+ |

| [X] of the Best Resorts in Menorca | Best Resorts in Menorca | 880 | 63 (wrong intent) |

| [X] of the Best Resorts in Thailand | Best Resorts in Thailand | 880 | 100+ |

| [X] of the Best Resorts in Antalya | Best Resorts in Antalya | 720 | 66 (wrong intent) |

Right now, Thomas Cook has pretty much no visibility for this type of query.

TUI, a major competitor, on the other hand, is enjoying tens of thousands of sessions every month with this type of content.

For example, they rank #2 on Google for ‘best resorts in Turkey’ with the following piece of content:

It’s safe to say that it wouldn’t be massively difficult to create something better than this.

Whilst it ranks, it’s nothing overly impressive, and it wouldn’t take too much effort to add a lot more value. And this, in my opinion, means it should be relatively easy for Thomas Cook to rank quickly for this type of term if it was to produce the content.

And it’s a scalable format. Effectively, it’s a listicle of recommended resorts, something that Thomas Cook could easily produce. And could they bring more of a methodology into how the ‘best’ resorts are identified? Of course they could…

In fact, a closer look at TUI’s page shows that it doesn’t really match the intent very well. Yes, it mentions hotels and resorts within the areas, but a lot more could be done to really help the searcher to find recommendations.

3. [Destination] or [Destnation]

Often, during the research stage of booking a holiday, two or more similar destinations are being considered.

Take Prague and Budapest, for example. Two European capitals, but which one should you visit for your next city break?

Corfu or Crete? The Maldives or Mauritius? The list goes on…

And these ‘destination comparison’ keywords are an important part of the planning phase or travel, and one that Thomas Cook doesn’t have visibility for right now but absolutely should.

After all, if you’re the brand that is helping a tourist to choose their destination, you’re significantly increasing the likelihood that they’ll at least check out what you’ve got to offer in that place.

Here’s a look at some of the opportunities with this type of content:

| Title | Main Keyword | MSV | Rank |

|---|---|---|---|

| Prague or Budapest: Which Should You Visit? | Prague or Budapest | 480 | 100+ |

| Corfu or Crete: Which Should You Visit? | Corfu or Crete | 480 | 100+ |

| Maldives or Mauritius: Which Should You Visit? | Maldives or Mauritius | 390 | 100+ |

| Dalaman or Antalya: Which Should You Visit? | Dalaman or Antalya | 320 | 60 (wrong intent) |

| Bali or Thailand: Which Should You Visit? | Bali or Thailand | 320 | 100+ |

| Gran Canaria or Tenerife: Which Should You Visit? | Gran Canaria or Tenerife | 320 | 55 (wrong intent) |

| Madrid or Barcelona: Which Should You Visit? | Madrid or Barcelona | 320 | 100+ |

| Marmaris or Antalya: Which Should You Visit? | Marmaris or Antalya | 260 | 75 (wrong intent) |

| Corfu or Rhodes: Which Should You Visit? | Corfu or Rhodes | 260 | 100+ |

| Abu Dhabi or Dubai: Which Should You Visit? | Abu Dhabi or Dubai | 260 | 100+ |

If we take a look at what’s ranking for these queries right now, we see the following as an example:

The top results on the SERPs are a mix of guides and a Reddit thread from as far back as 2014 (hi, TripAdvisor), largely in an editorial format that explores the two cities.

Not hard to replicate, but I’ve spotted an opportunity to add more value here, especially knowing that one of the most common things Google targeted in the HCU was content that didn’t really answer the query. At least, not concisely.

I’d look to create similar editorial pieces to these, but with the addition of a table that directly compares key factors which are then explored further into the full guide.

Imagine a quick comparison table on things like the average cost, who it’s best suited to (families, couples etc), best time of year to go. There are all sorts of things that could be worked into a simple but effective comparison…

Most of the top rankings for “Prague vs Budapest” as a query are based around pitting one against the other on things like river views, castle districts and more, but are these really what tourists are making decisions on?

I’m not so sure, and that’s why I’d go in here leading with a comparison table of the things that really matter to tourists.

4. [Destination] Multi Centre Holidays

Understanding how people search is the key to crafting a successful content strategy, and one way that thousands of tourists are searching each month is for multi centre holidays.

Yet Thomas Cook has pretty much no visibility for these types of searches at the moment.

Have a look at how they’re ranking against the opportunities:

| Title | Main Keyword | MSV | Rank |

|---|---|---|---|

| Thailand Multi Centre Holidays: Where to Visit | Thailand Multi Centre Holidays | 1,900 | 90 (wrong intent) |

| Italy Multi Centre Holidays: Where to Visit | Italy Multi Centre Holidays | 880 | 100+ |

| USA Multi Centre Holidays: Where to Visit | USA Multi Centre Holidays | 720 | 100+ |

| Bali Multi Centre Holidays: Where to Visit | Bali Multi Centre Holidays | 480 | 100+ |

| European Multi Centre Holidays: Where to Visit | Europe Multi Centre Holidays | 390 | 100+ |

| Croatia Multi Centre Holidays | Croatia Multi Centre Holidays | 320 | 89 (wrong intent) |

| Cuba Multi Centre Holidays | Cuba Multi Centre Holidays | 320 | 86 (wrong intent) |

| Canada Multi Centre Holidays | Canada Multi Centre Holidays | 260 | 98 (wrong intent) |

| Singapore Multi Centre Holidays | Singapore Multi Centre Holidays | 260 | 97 (wrong intent) |

| Vietnam Multi Centre Holidays | Vietnam Multi Centre Holidays | 260 | 100+ |

If we look at the type of content that’s ranking for these queries, it’s editorial roundups on recommendations on different destinations to visit on a multi-centre trip to a certain destination, such as this from British Airways:

It gives you a good idea on what Thomas Cook would need to create, but I’d be inclined to look at what else could be done to this.

The BA guide includes popular multi-centre options, but it’d be nice to see one or two that are maybe a bit less known. It’s things like that which really help content to stand out in 2024. At the end of the day, people want to find information they may not know, and Google wants to serve this.

I’d take a guess that, from these recommendations, at least Chiang Mai and Phuket are on anyone who is considering Thailand’s list anyway, but what off-the-beaten-track destinations could be worked into a multi-centre trip?

Information gain should be a real focus for brands wanting to own the SERPs in 2024, looking at how to do more than just repurpose what’s already given as part of the results that rank.

5. [X] of the Best [Resorts / Hotels] in [Destination] for [Traveller Type]

The more specific a searcher goes with their query, the more of an opportunity a brand has to turn that search into a conversion. In this case, a booking.

That is, of course, so long as you’re able to meet the intent and really help to return what they’re looking for.

And another opportunity for Thomas Cook is to expand on the “Best resorts in…” keyword type we looked at earlier, adding the traveller type onto the query.

For example:

- Families

- Couples

- Adults

- Older Couples

- Middle-Aged Couples

The list goes on, and there are plenty of opportunities, as we see here:

| Title | Main Keyword | MSV | Rank |

|---|---|---|---|

| [X] of the Best Resorts in Turkey for Families | Best Resorts in Turkey for Families | 1,300 | 18 (wrong intent) |

| [X] of the Best All-Inclusive Hotels in Spain for Families | Best All-Inclusive Hotels in Spain for Families | 480 | 10 (wrong intent) |

| [X] of the Best Hotels in Dubai for Couples | Best Hotels in Dubai for Couples | 480 | 100+ |

| [X] of the Best Hotels in Costa Adeje for Adults | Best Hotels in Costa Adeje for Adults | 480 | 48 (wrong intent) |

| [X] of the Best All-Inclusive Hotels in Tenerife for Adults | Best All-Inclusive Hotels in Tenerife for Adults | 390 | 17 (wrong intent) |

| [X] of the Best Resorts in Greece for Couples | Best Resorts in Greece for Couples | 320 | 53 (wrong intent) |

| [X] of the Best Resorts In Corfu for Middle-Aged Couples | Best Resorts In Corfu for Middle-Aged Couples | 260 | 100+ |

| [X] of the Best Resorts in Tenerife for Older Couples | Best Resorts in Tenerife for Older Couples | 170 | 100+ |

| [X] of the Best Resorts in Majorca for Young Families | Best Resorts in Majorca for Young Families | 170 | 62 (wrong intent) |

| [X] of the Best Resorts in Tenerife for Older Couples | Best Resorts in Tenerife for Older Couples | 140 | 100+ |

In many ways, the recommendations here are the same as they were for “best resorts in…” type queries, there’s just that need to get more specific.

Here’s an example that ranks for “Best resorts in Turkey for Families,” that, without too much work, I’m confident Thomas Cook could outrank.

We know that Google has shifted away from ranking travel blogs in a lot of cases, especially those that are plastered with ads. But this is still ranking, just below TripAdvisor who take the top spot for this query.

Why?

My guess is that it’s because very few other pieces of content exist that target the query well enough. The top results on the SERPs are a mix of more generic publishers (Good Housekeeping and The Times) and accommodation-style listings, as well as instances of pages that don’t even target the query and are ranking with “best resorts in Turkey’ content.

I see this as an opportunity. A big one.

Does Thomas Cook have more authority to rank for this type of query than Good Housekeeping? I’d argue that it definitely does. But unless these content gaps are closed, they’re not going to rank…

6. The Best [Holiday Type] Destinations

Moving back up to the start of the destination search phase of a travel booking, we’ve got searches for the best destinations for a particular holiday type. For example, for family holidays, for couples or for winter sun.

Here’s a look at just some of these queries:

| Title | Main Keyword | MSV | Rank |

|---|---|---|---|

| Revealed: The Best Family Holiday Destinations | Best Family Holiday Destinations | 3,600 | 45 (wrong intent) |

| Revealed: The Best Winter Sun Destinations | Best Winter Sun Destinations | 2,900 | 100+ |

| Revealed: The Best Holiday Destinations for Couples | Best Holiday Destinations for Couples | 1,300 | 100+ |

| Revealed: The Best Lads Holiday Destinations | Best Lads Holiday Destinations | 1,000 | 100+ |

| Revealed: The Best Cheap Holiday Destinations | Best Cheap Holiday Destinations | 880 | 100+ |

| Revealed: The Best Summer Holiday Destinations | Best Summer Holiday Destinations | 880 | 100+ |

| Revealed: The Best Christmas Holiday Destinations | Best Christmas Holiday Destinations | 720 | 46 (wrong intent) |

| Revealed: The Best Party Holiday Destinations | Best Party Holiday Destinations | 720 | 100+ |

| Revealed: The Best Solo Travel Destinations | Best Solo Travel Destinations | 720 | 100+ |

| Revealed: The Best Beach Holiday Destinations | Best Beach Holiday Destinations | 590 | 100+ |

Right now, Thomas Cook isn’t visible when searches for this type of query are made, but they should be.

Especially in travel, success comes from being there at every stage of the booking journey; and that starts with helping someone to find that perfect destination.

Just think about it, when travel agents operated pretty much exclusively on the high street, it was normal to go in and have a chat and walk out with a few brochures for different destinations that match what you’re looking for or want from a holiday.

What next?

You’d have a look and go back in a few days later to book.

And we should be thinking about informational content in 2024 as part of this same process. Maybe brochures are a thing of the past for a lot of us, but it doesn’t mean the booking journey is much different. It’s just taken on a new format.

Be visible at every stage of that journey and you’re far more likely to land that booking.

Here’s TUI’s page that ranks for ‘best family holiday destinations’:

Again, could something that adds more value be produced? Of course, it could, but it goes to show that Google wants to rank content from sites like TUI and Thomas Cook right now.

And when there’s an opportunity, it’s there to be doubled down on.

When we think about that high-street travel agency experience, it makes perfect sense for Thomas Cook to be producing this type of content. It’s what they know, what they offer and what they’ve been helping people with for years.

An Opportunity to Accelerate SEO Success

In my opinion, Thomas Cook has a massive opportunity here. One that could help them to generate a significant step up in organic traffic in 2024.

You see, the only way to guarantee you won’t rank for a query is to not have content that properly targets it. And in this case, there are so many examples where this is true. And that’s only scratching the surface.

If Thomas Cook doesn’t leverage these opportunities to unlock its untapped potential from informational content, another brand will…