International SEO Forecasting: How to Determine the Investment Needed and the Potential Returns When Entering New Markets (w/ FREE Template)

November 12, 2024 • 17 min read

New markets mean new opportunities to unlock untapped revenue potential from new audiences.

Expanding internationally though, whether that’s for the first time or into additional territories, needs careful consideration. Launching into new markets can result in rapid growth, often allowing a business to scale much faster than slowly taking more market share domestically, and a key contributor to this can be the execution of a successful international SEO strategy.

But whilst international expansion can be an incredibly attractive growth strategy, you need to choose your new markets carefully, especially when it comes to SEO.

Just think about it this way…

SEO needs investment if you want the channel to drive growth. Often significant investment.

And for this to be justified, you need to know the size of the opportunity, the level of competition and, based on this, an idea of the level of investment that’s needed and when returns can be expected.

In many cases, you also need to be able to answer the question of “which market(s) offer the biggest opportunity for SEO to have an impact?”

Unlike paid channels, where you can easily and quickly ‘test the water’ in a new market, SEO isn’t quite so simple. But with the right approach, you can leverage data to help you make decisions and recommendations.

In this guide, that’s exactly what I’m going to teach you how to do; forecast the SEO potential of any markets you’re considering going into.

This guide is based upon a talk I gave at the International Search Summit in Barcelona in November 2024. If you’d prefer to flick through my slides from the event, you can see them here:

The Challenge of SEO Forecasting for New Markets

There’s a challenge that comes with forecasting before entering a new market… the fact that you’ve not got historical first-party data to build these from.

If you’re forecasting future growth in an existing market, the most effective way to do this is based on your current (and previous) performance, using your own data to build forecasts and make decisions.

In fact, my preference for most forecasting is to build out a model that’s based on Google Search Console and GA4 data, using historical clicks, CTR and current average positions alongside 12 month position targets.

I’ve found this to be the most accurate method of forecasting growth, given the use of a site’s own CTRs for each position at keyword level rather than industry averages, and it’s a process I’ve developed over a few years.

I’m not sharing this right now (although we do use it for forecasting on all client projects), but there are lots of guides out there to help you build your own forecast based on historical data.

For some great resources to help you do this (if that’s what you’re looking to do), check out these:

- SEO Forecasting in 2024: How to Unlock Predictable Growth – Nick Eubanks, Traffic Think Tank

- SEO Forecasting: The Art Of Getting Buy-In – Patrick Stox, Ahrefs

- Estimating Search Opportunity — Whiteboard Friday – Robin Lord, Moz

- The Good, the Bad & the Unpredictability of SEO Forecasting – David Westby, Aira

But when it comes to entering a new market, you won’t have that first-party data available.

It’s as simple as the fact that you can’t forecast based on first-party data for a market you’re not trading in.

And this means you need to forecast based on a combination of assumptions and third-party data.

This is fine. After all, the purpose of this exercise is to identify the organic opportunity in potential markets and estimate the necessary investment and returns. We’re not building guarantees here, rather looking to gain an insight and some degree of data to help make decisions.

It does mean, though, that the process for this type of forecasting is probably a bit different to what you’ve done in the past.

The Value of International SEO Forecasting When Considering New Markets

Before we look in-depth at how to go about SEO forecasting for international expansions, I want to quickly touch upon the reasons why this process is so valuable. Especially given the obvious concern that it can only be done using third-party data.

When you put in the effort to forecast the scale of SEO opportunities in different territories, you’re able to:

- Determine the potential opportunity for new markets you’re considering

- Understand the competitive landscape for each

- Suggest the level of investment needed to see SEO success in each

- Understand how long it’s going to take to start to see an ROI

- Identify which markets have the most attractive opportunities

It’s all about putting together data to help you make decisions on whether or not a market is both worth investing in and the potential returns expected.

Effective forecasting helps companies to make data-driven decisions, and reduce risk while maximising ROI in new territories.

By understanding the market and its SEO opportunities, you’re in a place to make strategic recommendations. And whilst a decision for a business to enter any new territory is highly unlikely to be made on SEO recommendations alone (rather on things like the logistics of fulfillment, pricing, the local economic landscape and more), one thing we must remember is that it’s always an option to leverage paid channels in a market and not to focus on organic search, often for a period of time whilst a brand is built up.

Prioritisation can be a secret weapon when it comes to SEO success, and that couldn’t be more true when considering international expansion.

By following this forecasting approach, you’re building up the data you need to make strategic decisions and, as an SEO, make recommendations on how an ROI can be delivered.

How to Forecast for International SEO (+ Free Template)

Here’s how to forecast international SEO when planning to enter a new market. It’s a pretty quick and easy process, and one that will give you the insights you need to make decisions and recommendations.

Let’s use a working example; we’ll look at a retailer of blinds, curtains and window coverings. For context, let’s assume they’re currently trading in the UK market and are considering an expansion to other European territories. I’m using this example as it’s a market I’ve previously worked in across international SEO, but the process is the same regardless of your sector.

I’ll work through pulling data for the Netherlands as the market I’m analysing, but the process is the same for any.

I’m going to use Semrush and Ahrefs for this process as they’re my preferred tools of choice here.

To follow this process, you’ll need to grab a copy of my International SEO Forecasting Template. You can grab a copy for FREE below.

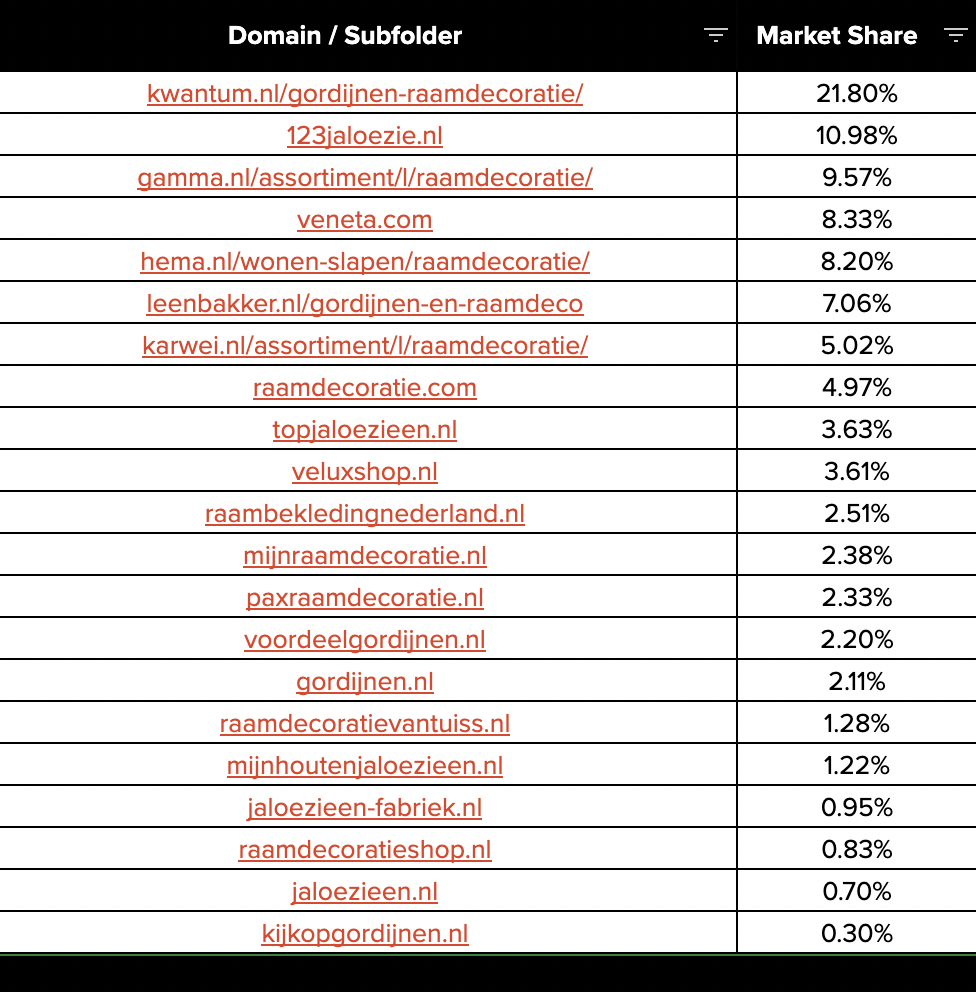

1. Identifying Your ‘Local’ Competitors

We’ll start by identifying who the main players are in each market.

If we can gain an insight into the top 20 to 30 competitors, including those who own the SERPs for non-brand terms relating to the products and services the business we’re forecasting for offers, we’re able to confidently estimate how much traffic is there for the taking.

When entering a new market, you probably won’t have the same level of competitor insight that you’d have in existing markets, which is why we’ll use the SERPs to identify who is currently performing well.

Start by identifying your top-level keywords.

In the case of our example, these are things like:

- Jaloezieen (Blinds)

- Gordijnen (Curtains)

I’m looking for broad terms that encompass the businesses offering, but can also get more granular here. 5 to 10 broad terms is usually sufficient here for most businesses, unless they offer a wider product range. In which case, you’ll need to expand further.

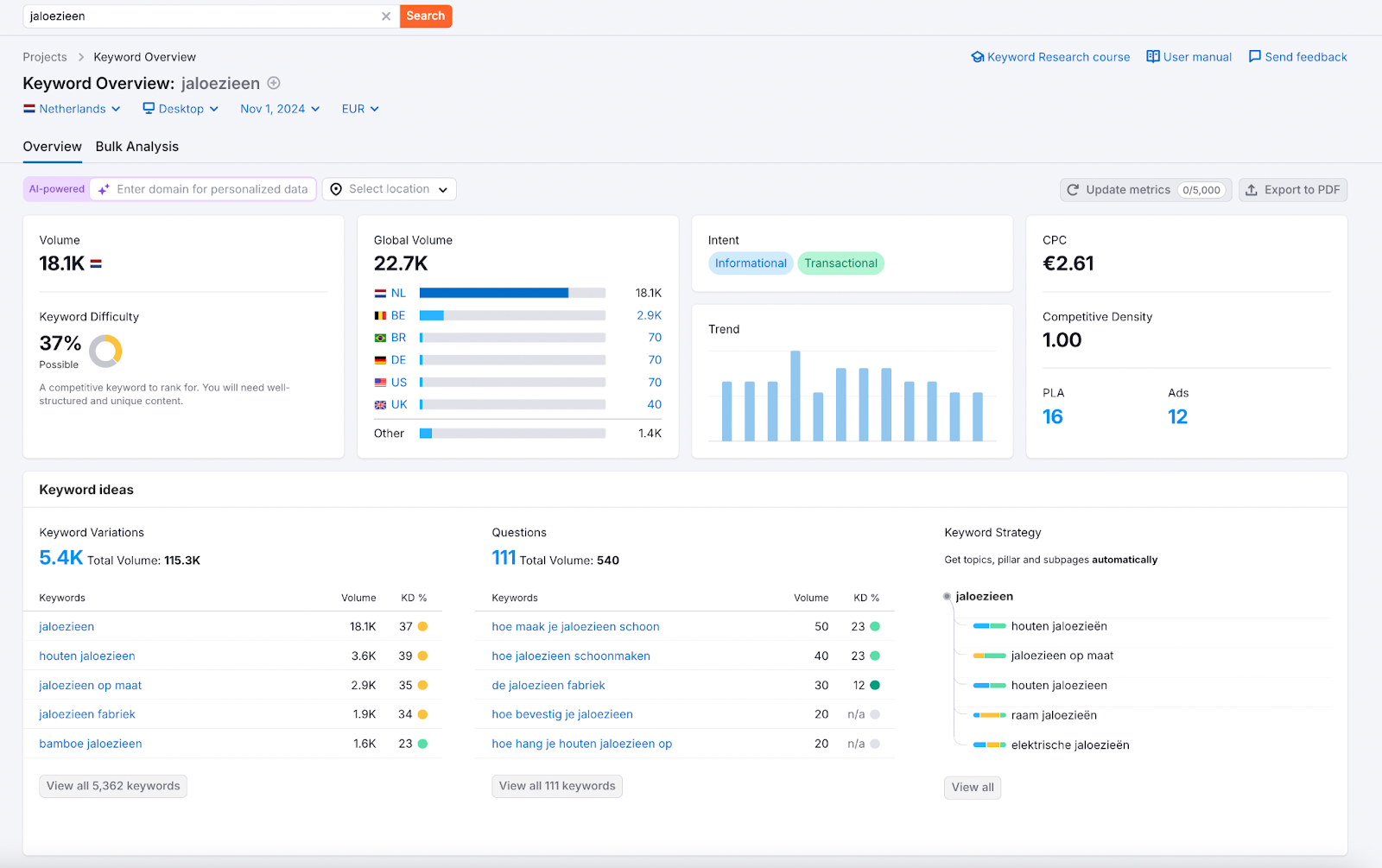

Once you’ve identified these terms, head to Semrush’s Keyword Overview tool and enter them one at a time.

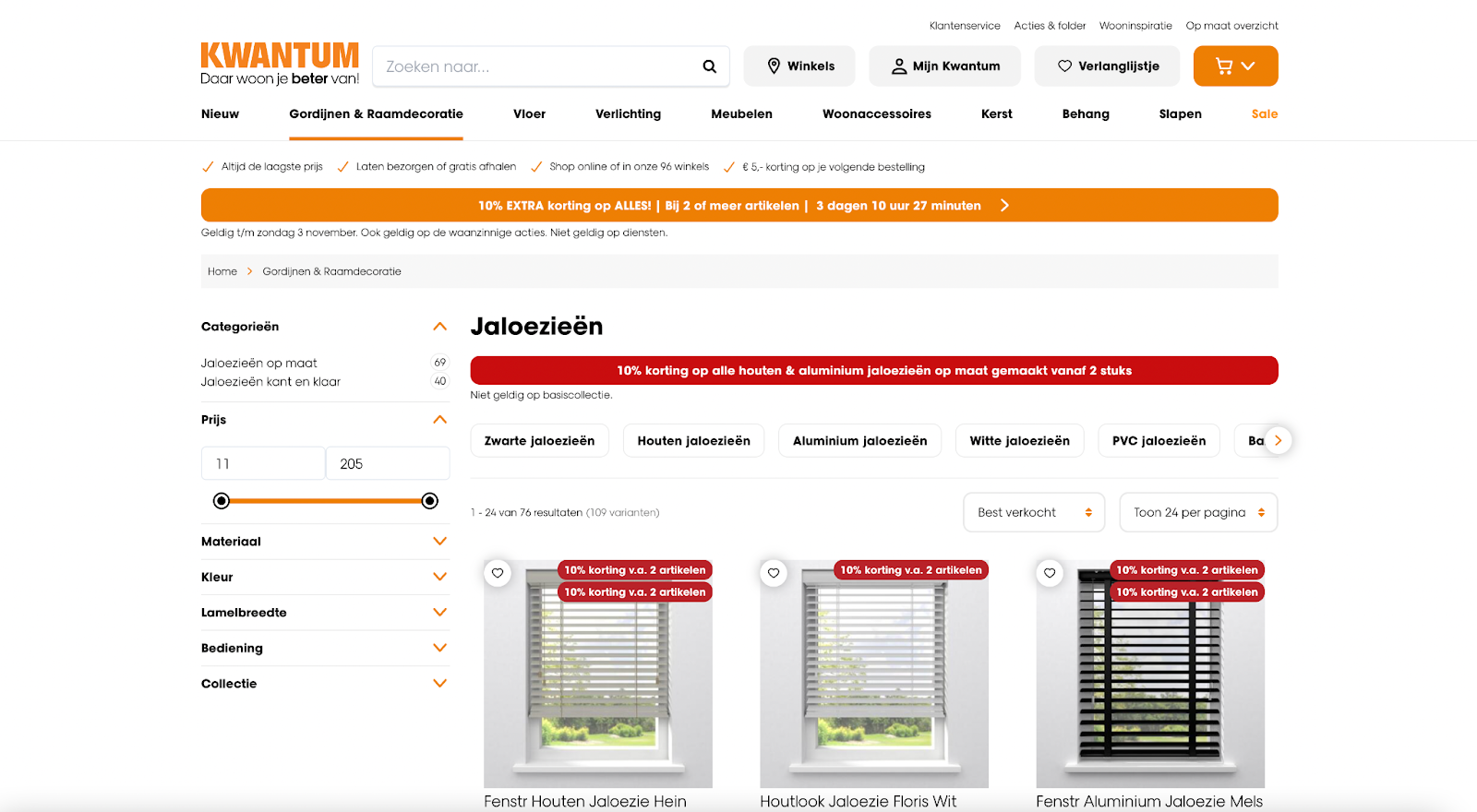

Here’s what’s returned when I search ‘jaloezieen’:

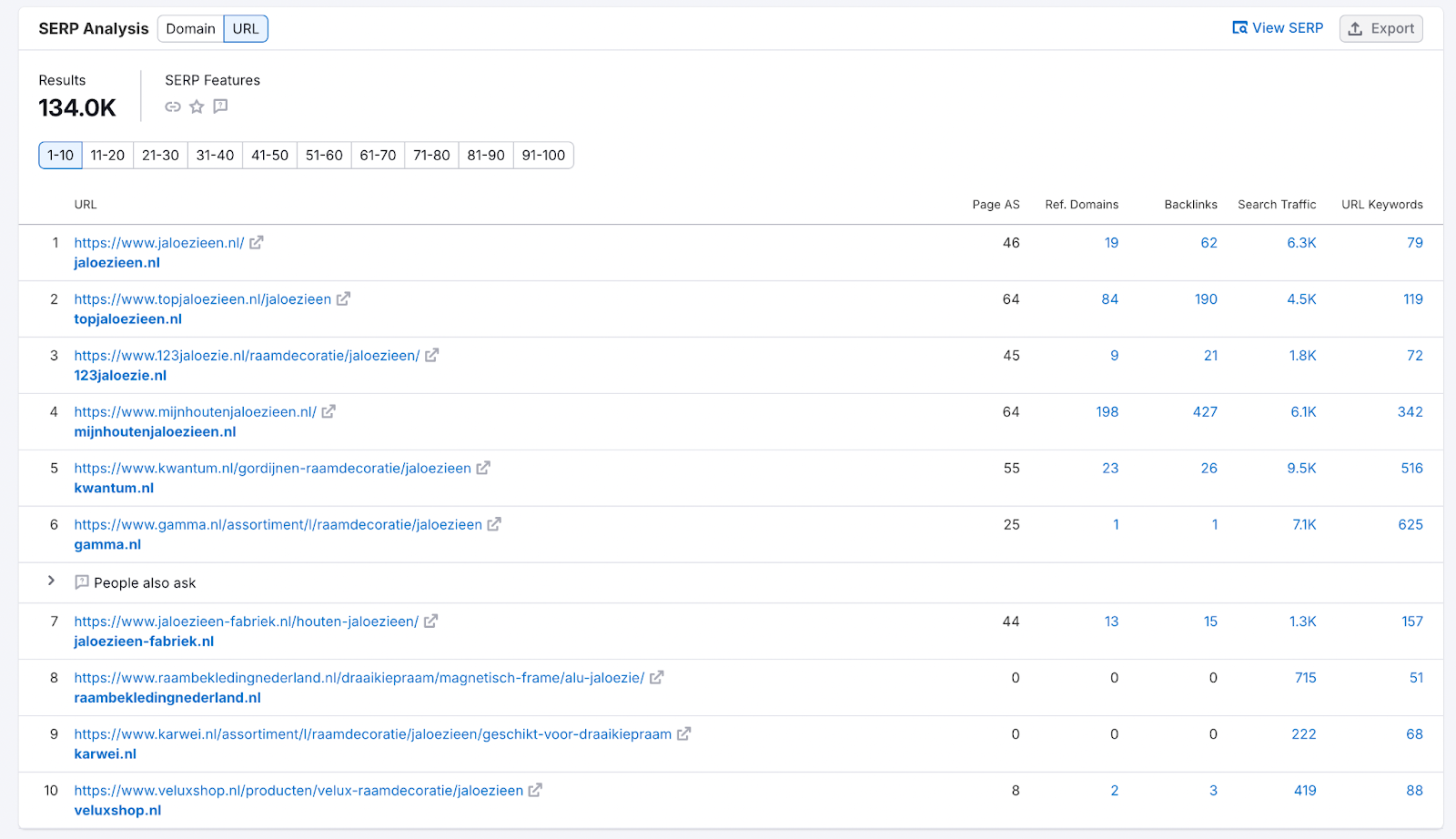

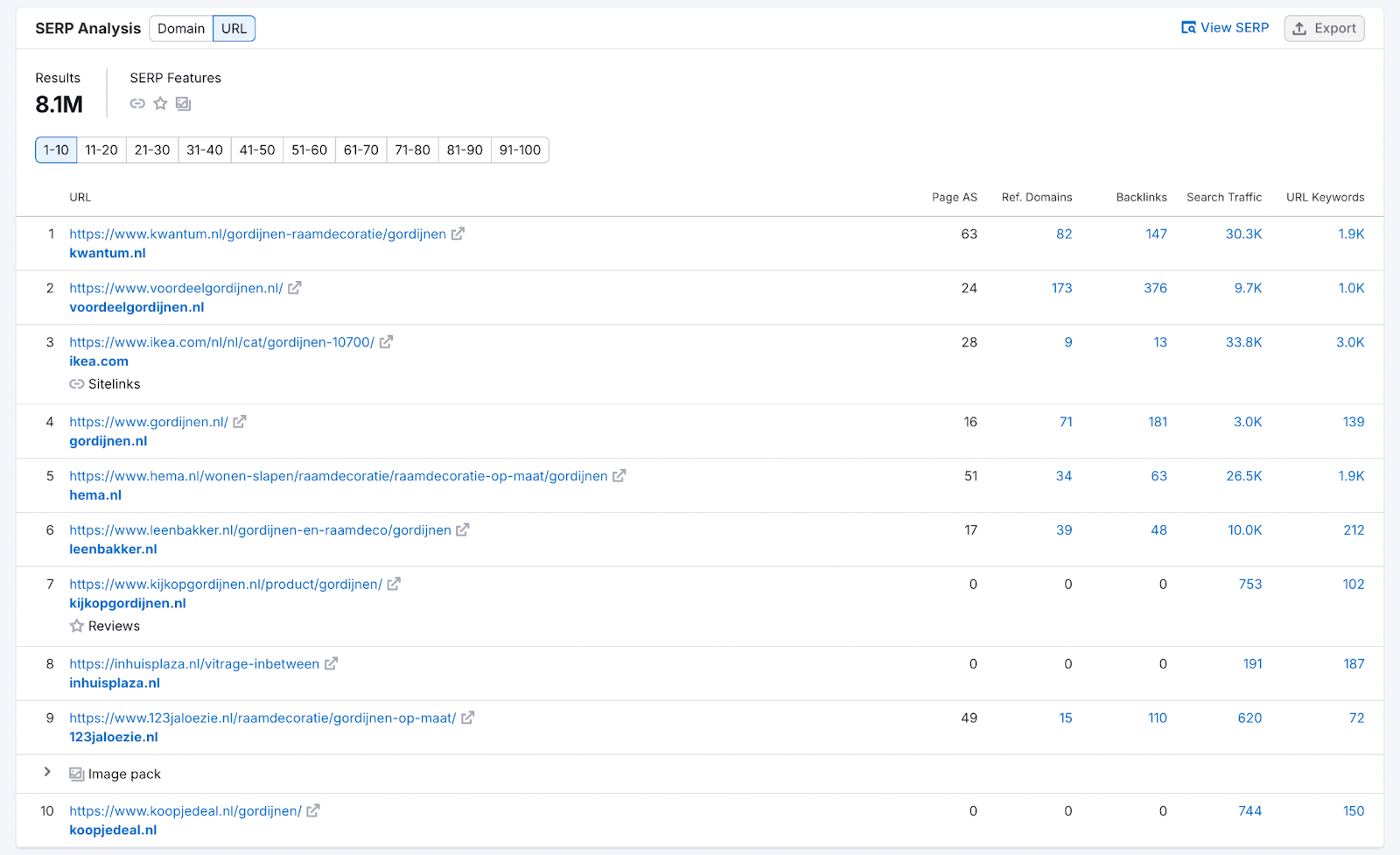

What we’re looking for here is the top 10 search results for the query.

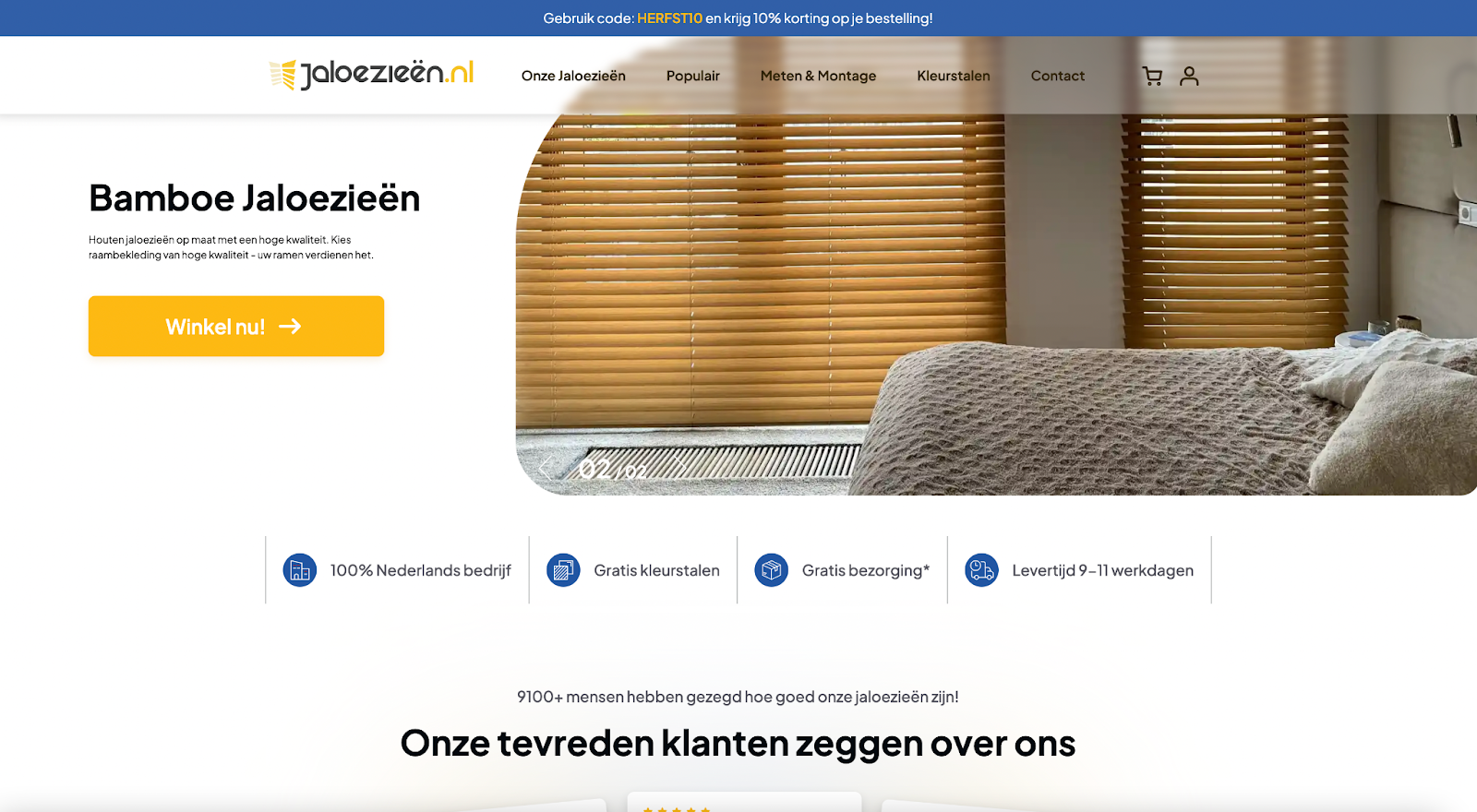

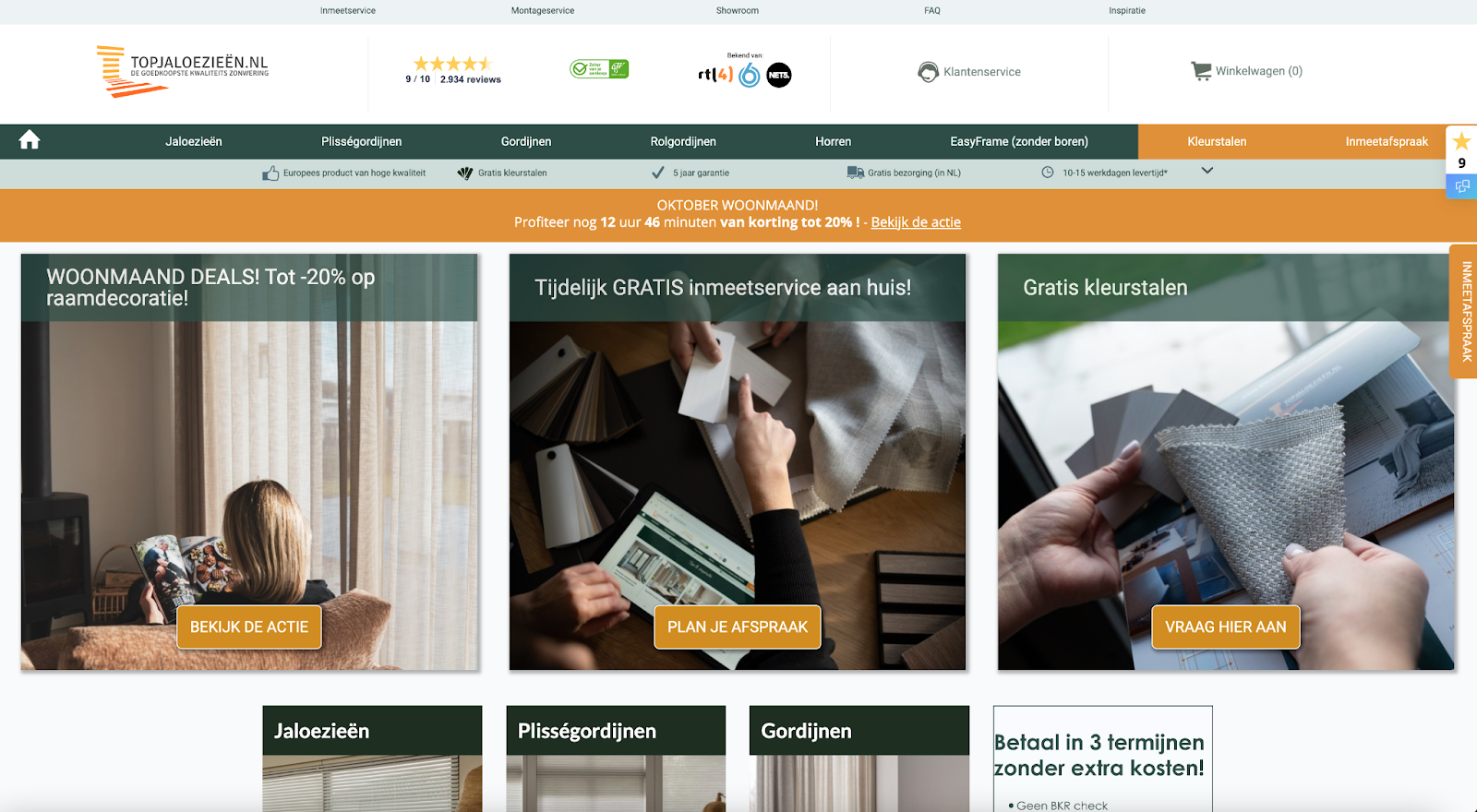

Here, you’ll find a list of domains that rank for the query. In this case, ‘blinds.’ And we can see pretty quickly that these are like-for-like businesses:

But we don’t just want to look at like-for-like businesses. That would mean overlooking the traffic that’s being earned by businesses that have a wider product offering, selling blinds, in this case, as just one of their product categories.

For example, Kwantum has a broader offering, yet has an extensive collection of blinds and curtains.

In this case, we want to look at the traffic being earned to that subfolder, rather than the entire site.

We want to know how much traffic is being earned to the same products as we sell, not the site as a whole.

You need to go deeper than just one or two broad keywords, at least when your offering is broader than a single product collection.

In this example, I’ve followed ‘jaloezieen’ (blinds) by a search in Semrush for ‘gordijnen’ (curtains).

Again, we’re looking to identify the top 10 results, of course expecting to see some crossover with the domains that ranked for the first term we looked at.

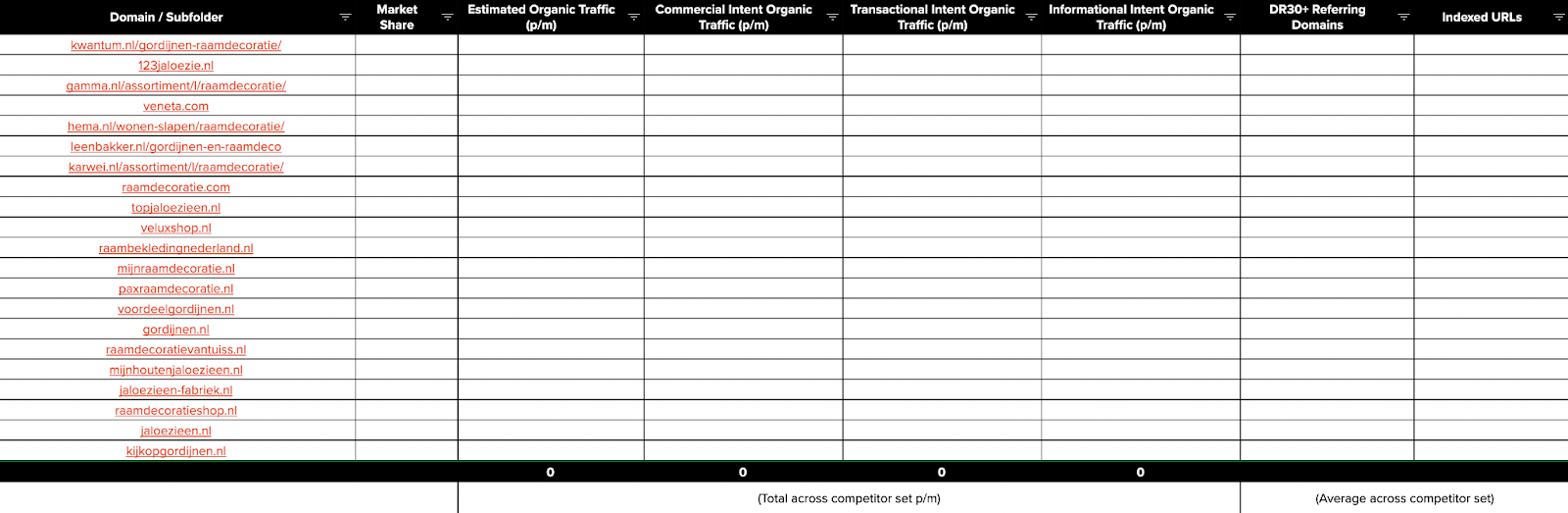

As you discover competitors, add them to your forecasting template.

If it’s a like-for-like competitor, add their root domain. If it’s a larger business with a much broader offering, add their subfolder.

Aim to add 20 – 30 competitors. Some markets may have less, some more. You want enough to cover as much of the market’s traffic acquisition in the sector as possible. Don’t worry if you’re adding smaller competitors too; they’re still worth including. Keep going until the crossover between queries means you’re not finding any new sites or subfolders to add. Doing this shouldn’t take more than about 15 minutes.

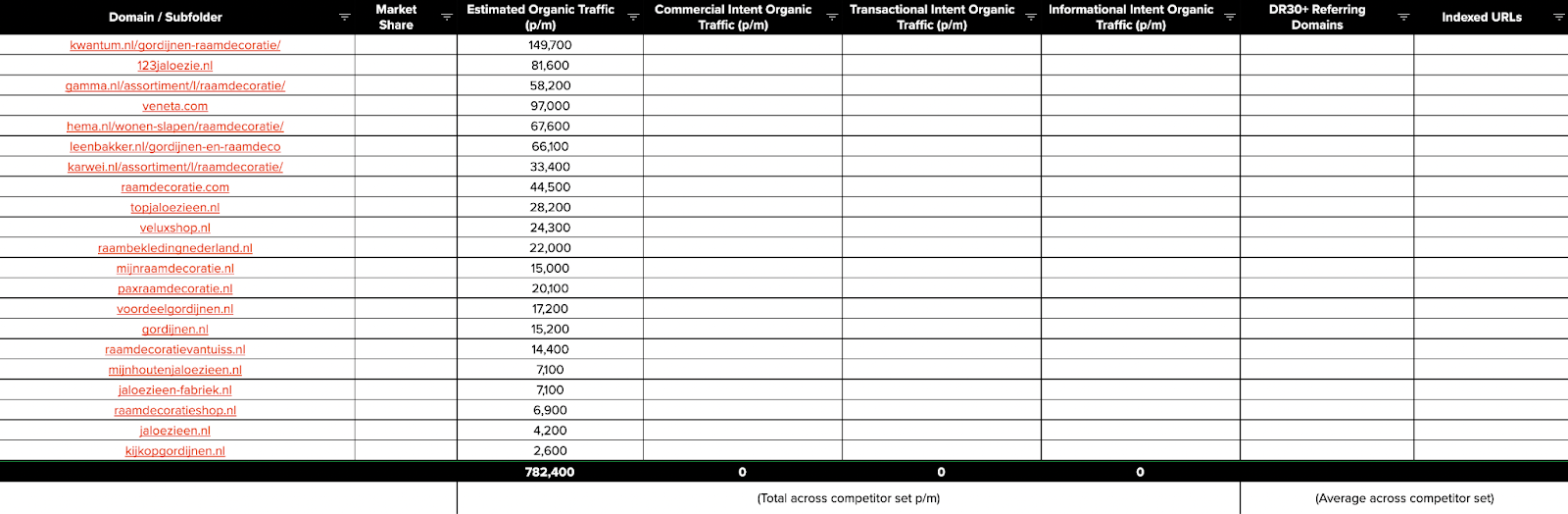

You’ll end up with your forecasting template’s ‘domain/subfolder’ column filled out.

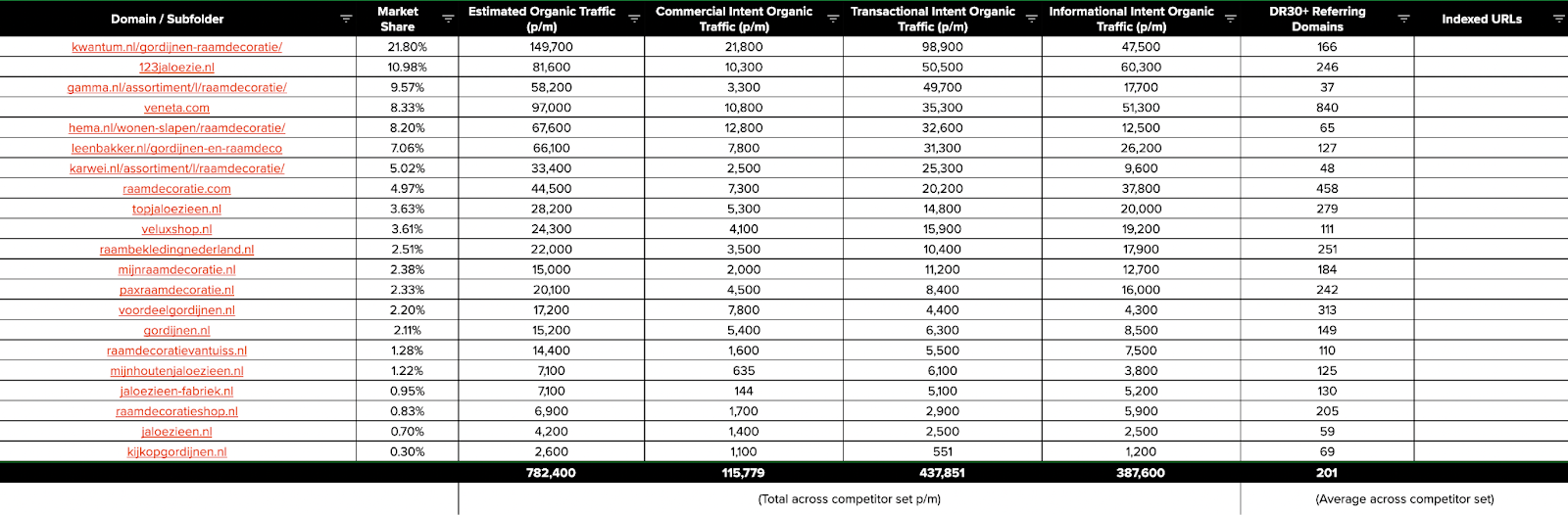

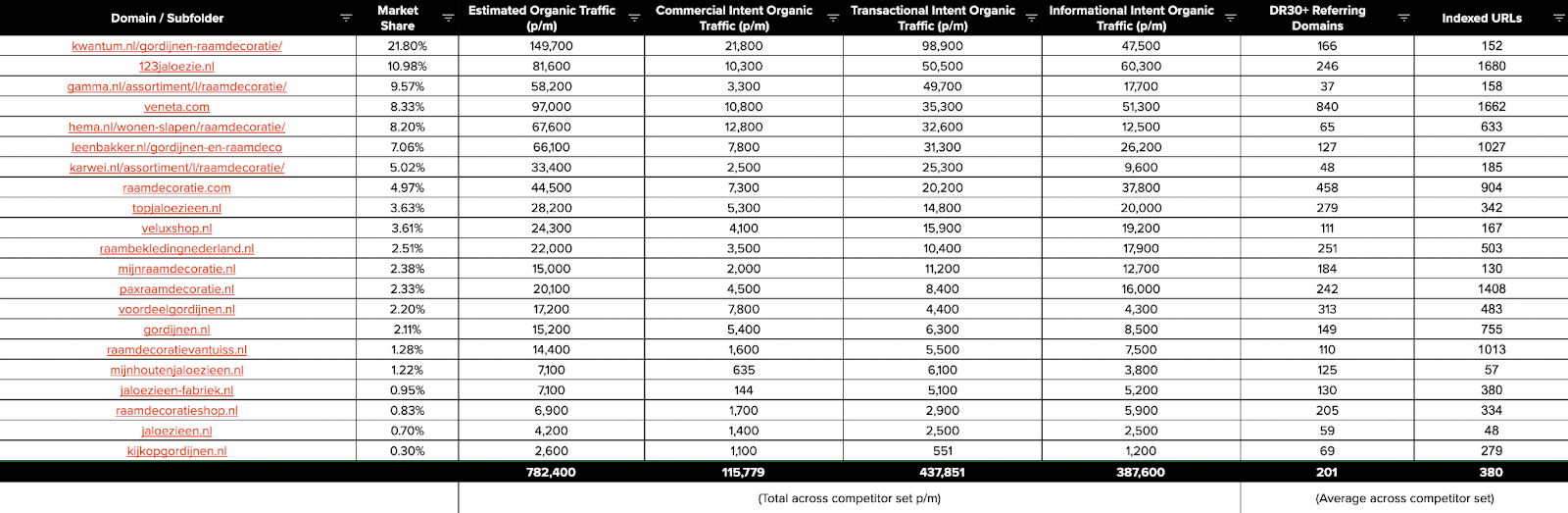

2. Analysing Competitor’s Organic Search Traffic

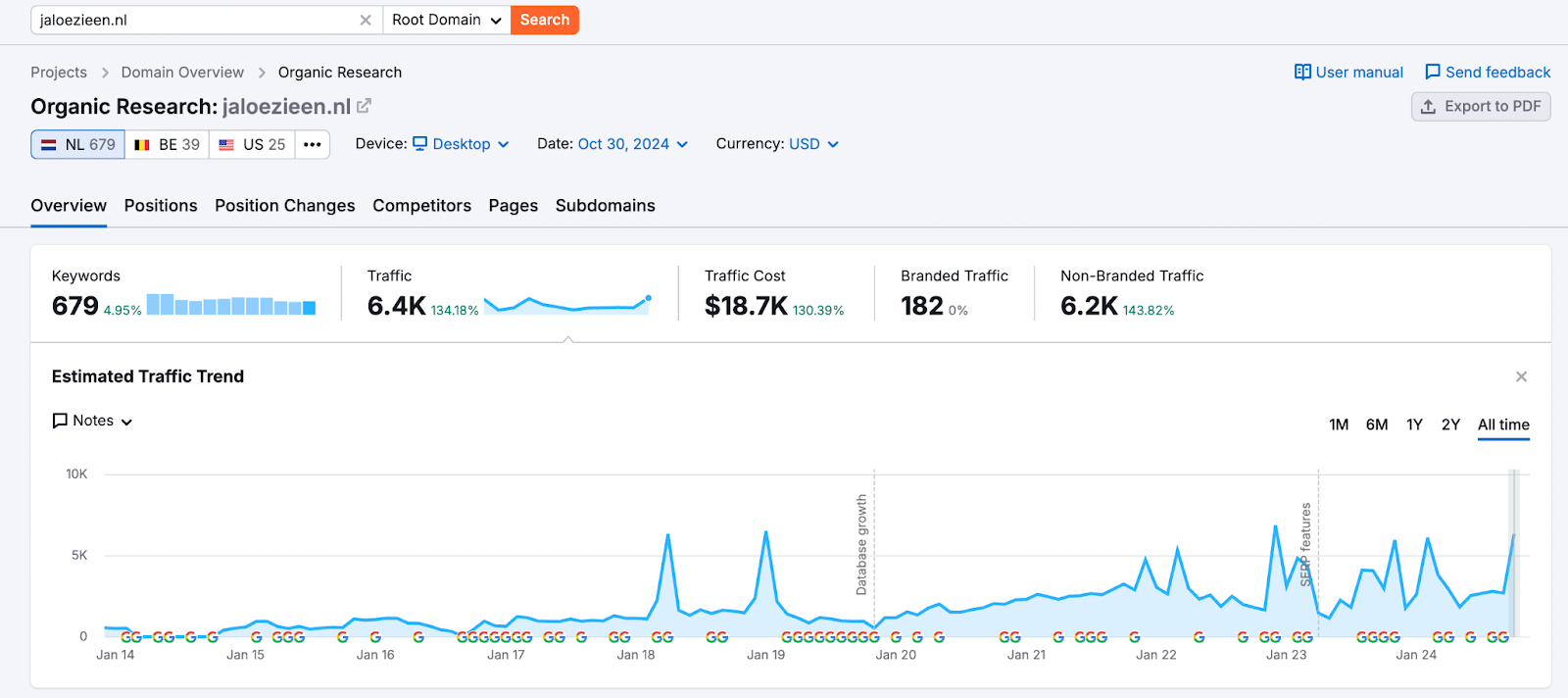

Once you’ve identified the competition in a market, you need to grab their estimated organic traffic. You can do this using Semrush’s Organic Research report:

Make sure you’re filtering the view by the market you’re considering entering (in this case, NL), to avoid traffic from outside the market from skewing your results.

Add the ‘traffic’ from the Semrush report for each competitor to your forecasting template.

Note the total at the bottom of the column on forecasting template? That’s the total organic traffic these sites are enjoying every month. In other words, the number of clicks that are coming from organic search to these sites; some of which you want to take away from these sites and earn for yourself.

Here you’ve got the total organic traffic in your sector in a market.

It’s a starting point but we can’t assume all of this traffic has the intent to buy or enquire. It won’t have.

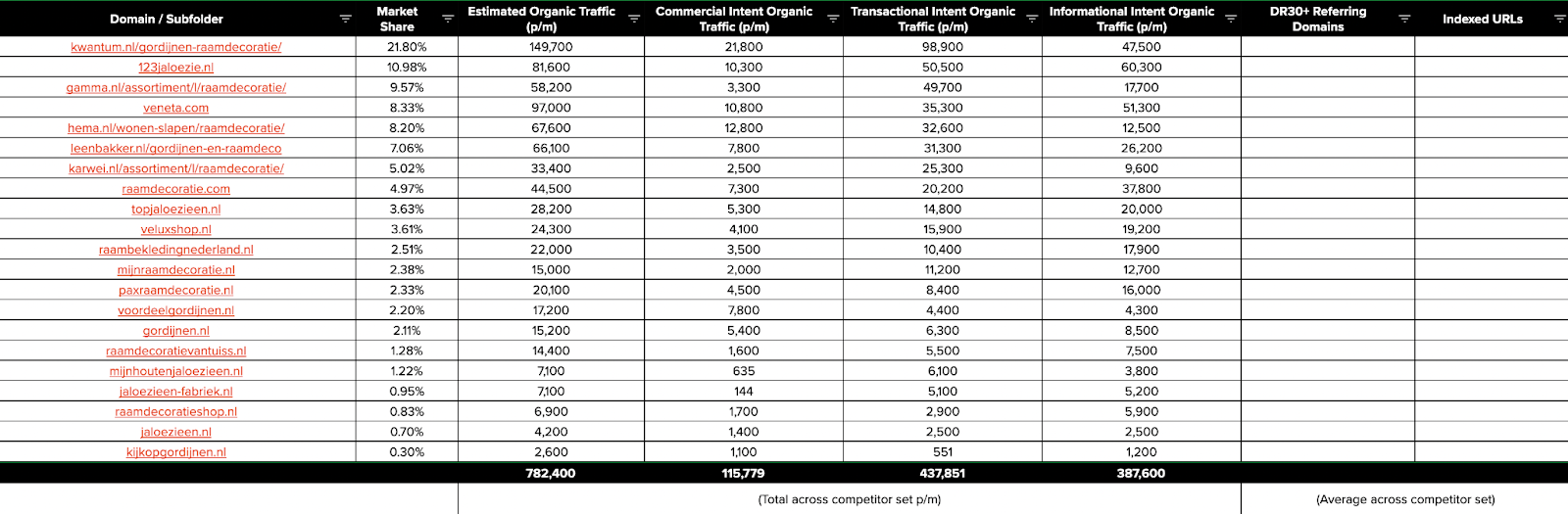

3. Isolating Out Competitor’s Commercial, Transactional & Informational Intent Organic Search Traffic

You can break traffic down into four intent groups:

- Informational intent. Users want to learn more about something (e.g., “how to clean blinds”)

- Navigational intent. Users want to find a specific page (e.g., “Facebook login”)

- Commercial intent. Users want to do research before making a purchase decision (e.g., “best window blinds”)

- Transactional intent. Users want to complete a specific action, usually a purchase (e.g., “buy window blinds”)

(I’ve taken these definitions from Semrush, given that’s where we’re getting our breakdown data from)

In order for our forecasts to be as accurate as they can be, at least in terms of calculating a market’s revenue potential, we need to make sure we’re not considering traffic that isn’t coming to a site with the intention to buy or enquiry, at least right now.

That’s not to say informational intent content and rankings don’t hold value. They absolutely do.

But we’re trying to estimate the potential revenue from a new market here, and the conversion rates for informational keywords are usually many times lower than for commercial and transactional ones.

So we base assumption-based forecasts upon commercial and transactional intent traffic estimates. We exclude informational and navigational traffic.

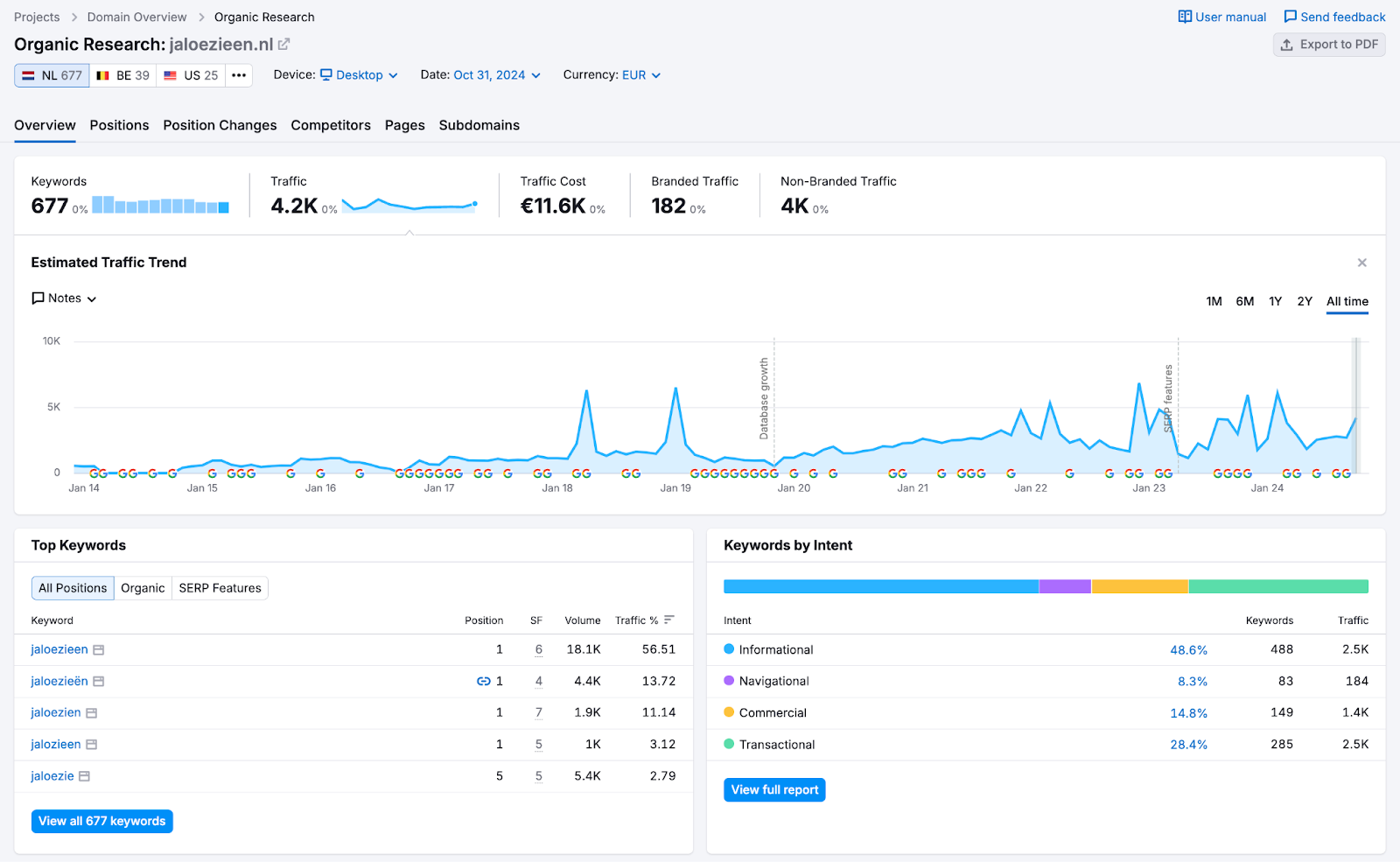

Semrush gives us this breakdown of competitors’ traffic in a market out of the box, so this is what we use.

Using the ‘Keywords by Intent’ insights from the Organic Research report (again making sure you’re still filtered to the target market), grab the Informational, Commercial and Transactional intent traffic estimates and add these to the corresponding columns on the forecasting template.

Whilst you don’t need to record the informational intent traffic estimates, I find that this is a useful way to understand how much extra opportunity there is to drive higher-up-the-funnel traffic.

4: Understanding Competitor Link Insights

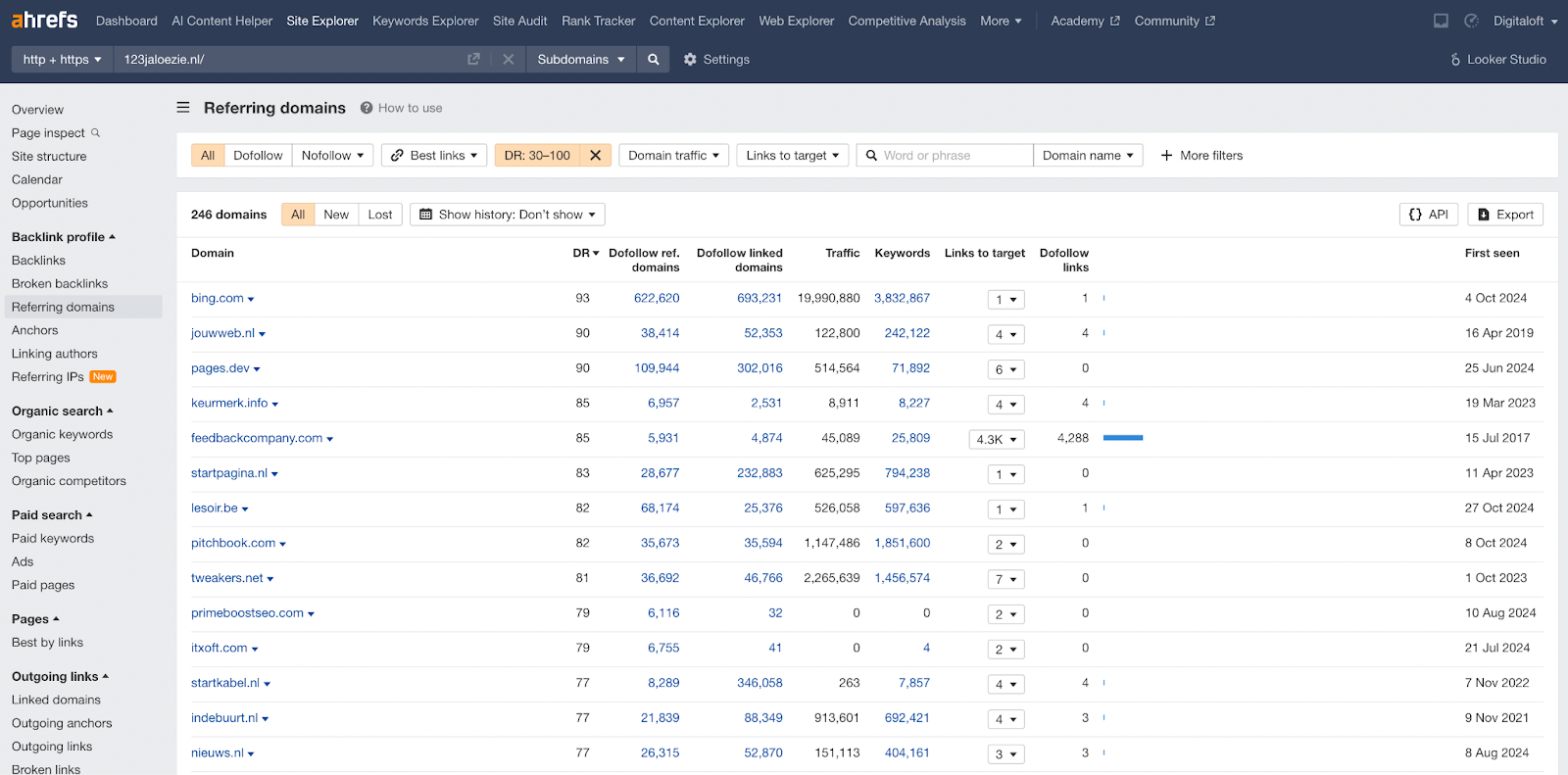

Links still matter, and for forecasting, we’re going to use them as a proxy for authority.

Yes, of course there’s more that goes into authority building than just the number of links, but as an easy-to-get and easy-to-compare approach, it works.

We’ll use ahrefs to grab the number of referring domains to the site or subfolder, excluding all domains <DR30. This lets us filter out low quality links that Google is likely ignoring; it gives us a far more accurate comparison of the types of links you need to actively go and earn.

Add the referring domain count for each competitor to your forecasting template:

The average at the bottom of the table? We’re taking the average number of DR30+ referring domains to give us a benchmark for what we’ll need to earn to compete.

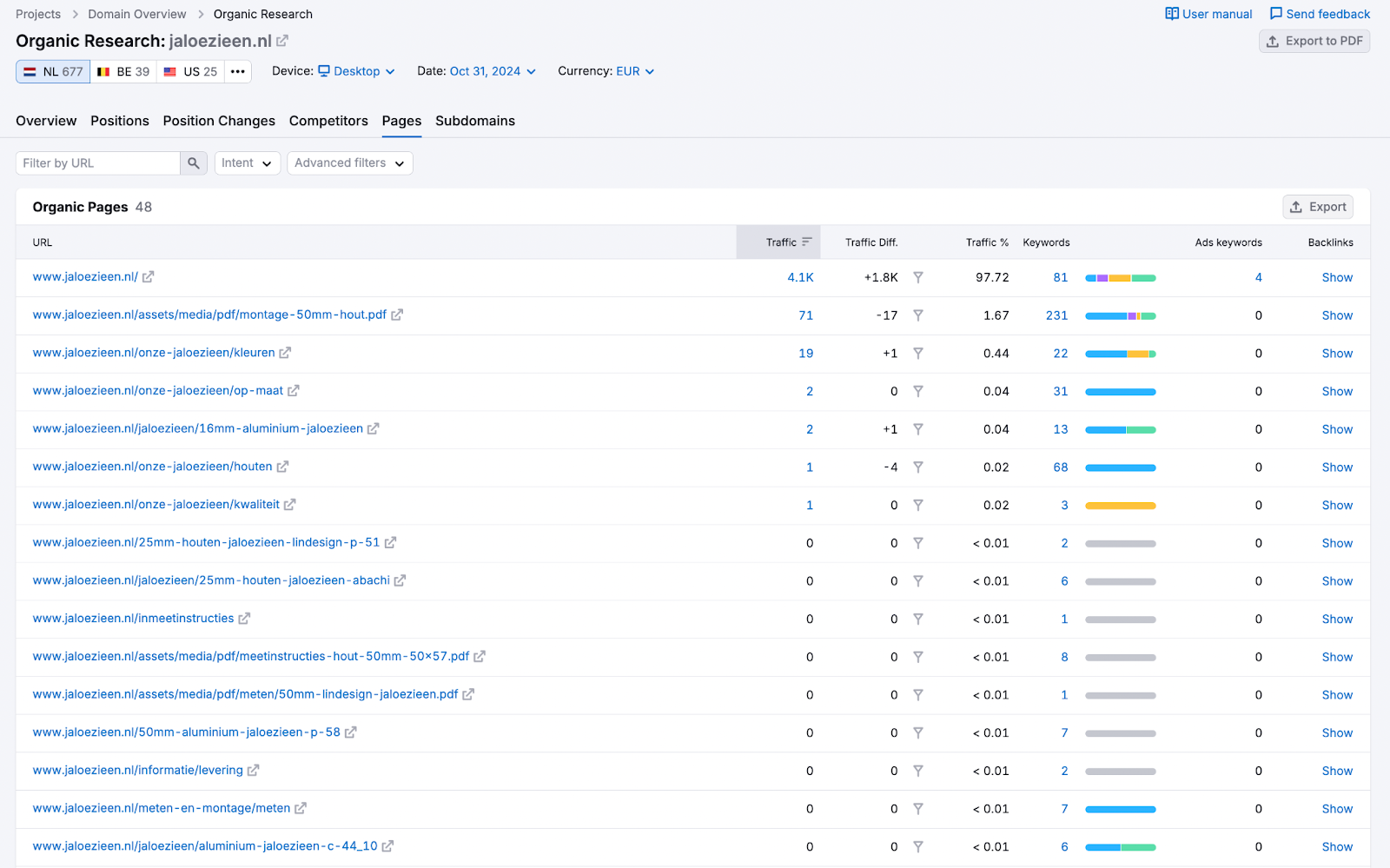

5: Understanding Competitor Page Counts

We need to understand the size of competitor sites so that we can estimate how much it’s going to cost to produce and/or translate and localise content.

We can get this insight from Semrush’ Organic Research tool, in the ‘Pages’ tab and grabbing ‘organic pages’ count.

Add the page count for each competitor to your forecasting template:

The average at the bottom of the table? We’re taking the average number of indexed pages to give us a benchmark for how much content we’ll need to produce to compete.

6. Estimating Your Organic Revenue Potential & the Cost to Compete

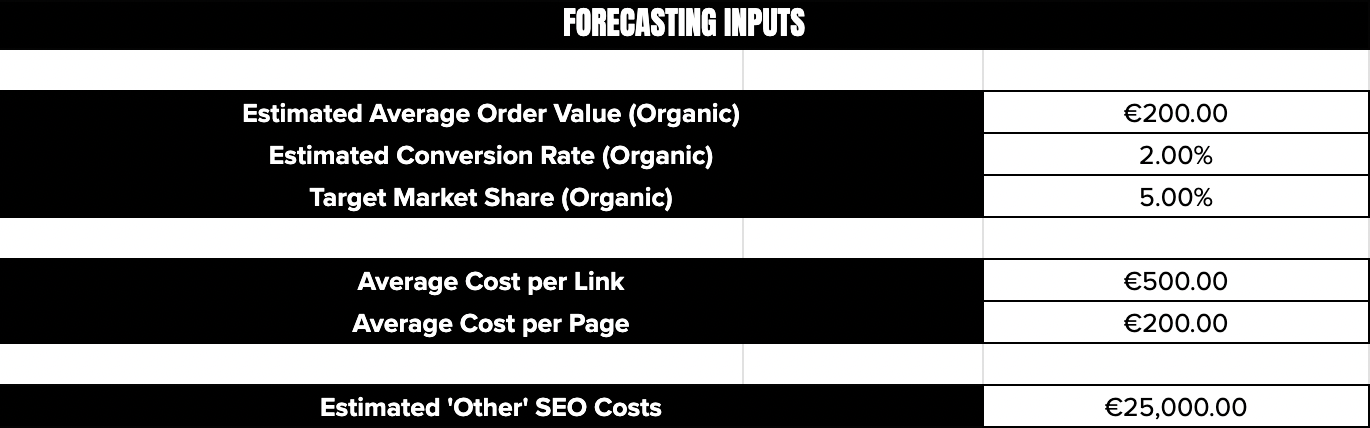

In order to estimate the revenue potential of a market, we need to make a few assumptions:

- Organic AOV (Average order value)

- Organic conversion rate

- Your target market share

If you’re a service based business, you might want to switch out AOV for CLV (Customer lifetime value) or a similar metric. You’ll get the same outcome, so feel free to customise the forecasting template to your own business’ needs.

Unless you’ve got any other insights available, I’d usually take current-market figures as estimates and drop the conversion rate back a little to compensate for the fact you’ve not yet built your reputation in the new market. And your competitors have.

If you’re getting a 2.5% conversion rate in the UK, use 2% in your international forecasts. If you get 1.5% in the UK, use 1% and so on.

Assuming your pricing strategy overseas is the same as your current market, you can usually keep this the same.

As a quick note on currencies; I strongly recommend you use your domestic currency in forecasts, not each market’s own. This makes it A LOT easier to compare the opportunity across markets later on.

If your main market trades in £, forecast in £.

If your main market trades in €, forecast in €.

We then need to set a target market share. You’ll find the current market share for each competitor (of transactional and commercial intent traffic) in the first column of the forecasting template, and this can be used to help you determine what’s realistic.

You also need to make an assumption on the average cost per link and cost per page of content.

This doesn’t mean the cost of buying a link; I’m not advocating that. But if you’re running digital PR activity for link acquisition, for example, there’s still going to be a ‘cost per link.’

This can differ significantly between markets and tactics, and I’m not going to give a recommendation here, but it’s something you need to take your best guess at.

You need to do the same for the cost per piece of content. This might mean to translate and localise your domestic market content or it might mean creating from scratch.

Lastly, you need to estimate ‘other’ SEO costs that you’ll face in order to compete in the market. These can include things like:

- Agency or freelancer costs to plan and execute a strategy

- In-house team costs

- Software costs

Try to estimate these over a project, rather than monthly.

Once you’ve got these, drop them into the forecasting inputs boxes on your forecasting template.

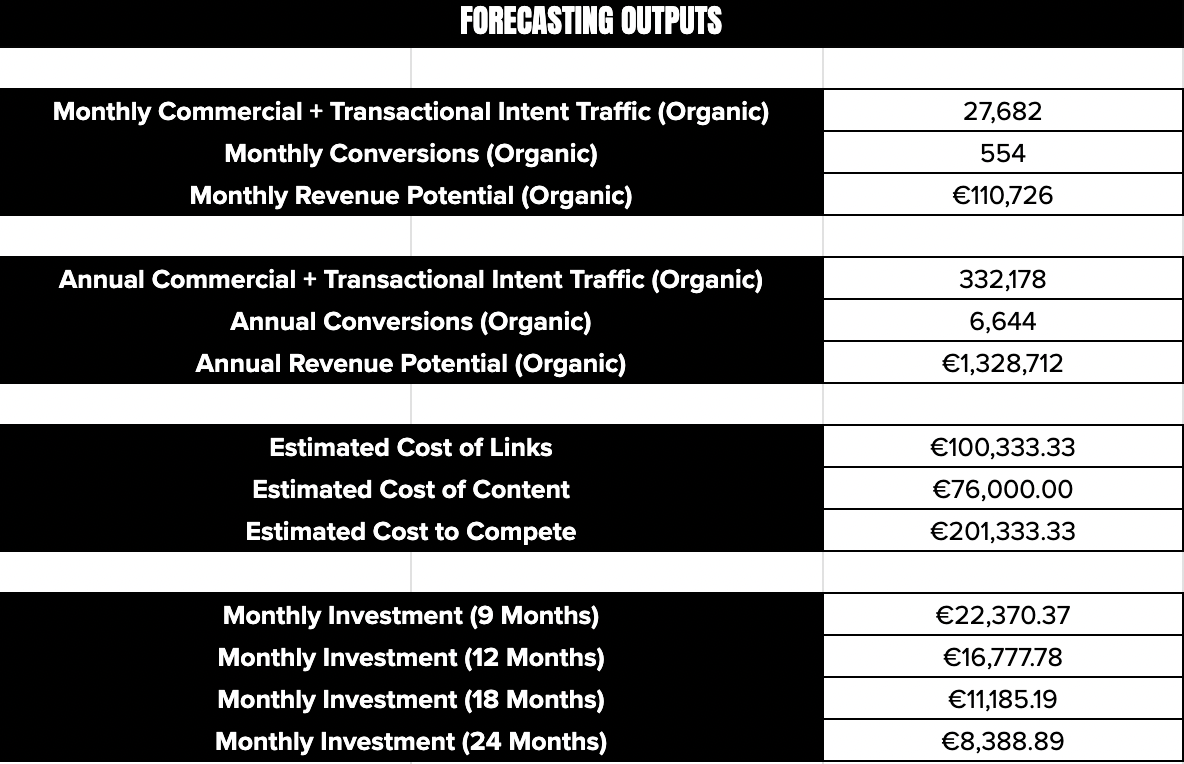

This will then calculate your forecasting outputs for you; the data that shows:

- The market opportunity size (monthly and annually)

- The cost to compete in the market

These outputs are what you can use to determine the organic potential (opportunity size) of a market, both monthly and annually.

But there are a few things you need to consider:

- This isn’t a ‘month by month’ forecast. That’s not the goal here

- We’re estimating the cost to compete to help justify investment and prioritise

- We can think of this as ‘the cost to catch up’

- This assumes you have the resources and SEO strategy to deliver growth

What we have here is a ‘cost’ and a ‘revenue potential.’ Two things you need to determine if a market’s worth entering and the ROI that’s possible.

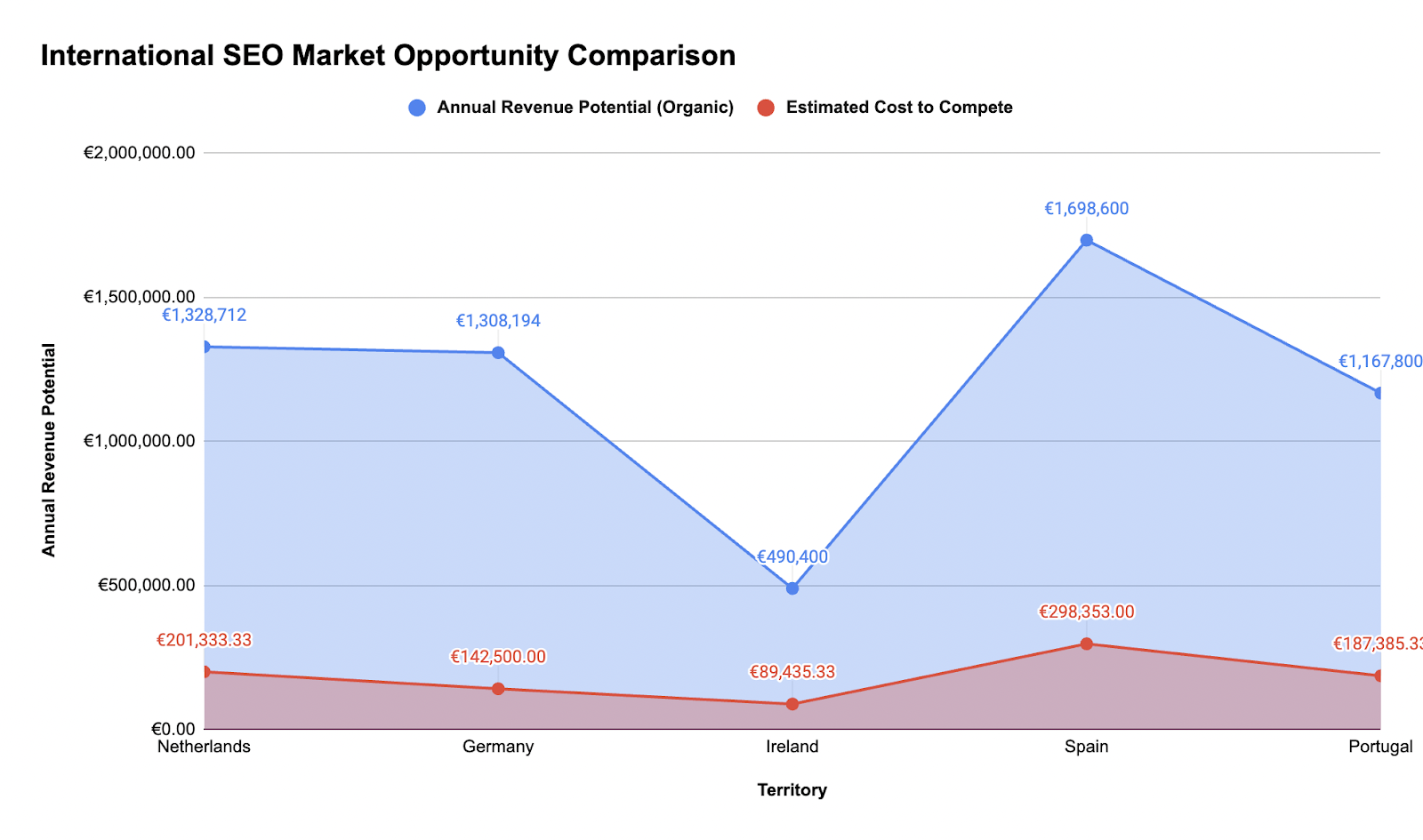

Comparing Multiple Markets to Determine the Biggest Opportunities

When expanding internationally, comparing potential markets can help you to justify and recommend the most promising opportunities.

By comparing multiple markets side by side, you can make data-driven decisions about where to allocate your resources and maximise your ROI.

And the front sheet of your forecasting template lets you see this insight, based on running an analysis of two or more markets.

Use this insight to determine which markets have the biggest opportunity, what the cost to compete is and which makes most sense for you at this moment in time, considering also your team’s skills, resources and other factors.

SEO Forecasting: Predictions, not Guarantees

SEO forecasting, especially when entering new international markets, is about using market insights to help you make informed decisions, justify investment and reduce risk, rather than being about making definitive guarantees.

And it’s important to remember this.

Without first-party historical data, we’ve got to use what we have available to inform our decisions and recommendations, and that’s more important than ever when considering entering new markets.

By analysing third-party data, identifying competitor traffic, and isolating commercial and transactional intent keywords, before combining this with business assumptions, you can create a solid forecast to guide decision-making. But remember, forecasts are roadmaps that help navigate opportunity, not exact outcomes.

This type of forecasting offers a calculated, data-backed approach to expanding globally – helping you to prioritise resources, set realistic expectations, and ultimately, support sustainable growth in new markets. With a strategic yet adaptable approach, you can build your brand’s presence internationally, confident in the direction but ready to adjust the path as needed.