How Can Cuvva Accelerate Its Organic Growth in 2024? [Untapped Potential #6]

By Ellie Wraith

July 24, 2024 • 15 min read

This deep dive is part of our Untapped Potential newsletter, where we reveal the SEO tactics we’d deploy to unleash the untapped potential of a different brand every week. Sign up to get more content just like this straight into your inbox every Wednesday.

Cuvva is one of the biggest players in the temporary car insurance game. Over the last 10 years, the team has sold nearly 9 million temporary insurance policies to over 1 million customers across the UK. Which, as Cuvva acknowledges, is a lot of insurance.

In terms of organic performance, cuvva.com is already seeing impressive results. The site drives (pun intended) in the region of 70,000 sessions per month, almost 45,000 of which come from non-branded keywords.

In the past 2 years, Cuvva’s visibility on SERPs has remained fairly consistent, with traffic hovering above and below the 70k mark month-on-month.

But, while Cuvva has certainly made a real name for itself in the temporary car insurance market, the brand could be doing much, much more.

Which is exciting, right?

But how can a well-established brand in the short-term car insurance industry shift its organic performance up a gear (pun also intended) in 2024?

Here, I dive deep into Cuvva’s current SEO strategy and tactics to distil the immediate actions and longer-term focuses we’d take if we were responsible for driving growth.

Cuvva: The Need-to-Knows

If you aren’t sure who Cuvva are, here’s a whistle-stop overview of the brand.

- It’s pronounced cuh-vah, like lover…not koo-ver, like hoover. Apparently, people get it wrong pretty often!

- Customers purchase cover through Cuvva’s app.

- Cuvva is on a mission to make insurance fairer and more flexible, one temporary policy at a time.

- It sees short-term car insurance as the best way to open up vehicle sharing across the UK.

- The team likes emojis, and who can blame them?!

- They have some seriously cute officedoggos (sorry, Chief Barketing Officers).

Benchmarking Cuvva’s Organic Footprint

Let’s break Cuvva’s performance down by topic pillar (product offering) to take a closer look at where things stand at present.

Temporary car insurance

| Keyword | MSV | Cuvva’s ranking |

|---|---|---|

| Temporary car insurance | 135,000 | 5 |

| Short term car insurance | 22,200 | 8 |

| One day car insurance | 14,800 | 8 |

| Learner car insurance | 9,900 | 14 |

| 1 day car insurance | 9,900 | 7 |

| One month car insurance | 3,600 | 9 |

| Pay as you go car insurance | 2,900 | 16 |

| Car insurance for a week | 2,900 | 6 |

Temporary van insurance

| Keyword | MSV | Cuvva’s ranking |

|---|---|---|

| Temporary van insurance | 6,600 | 4 |

| Day van insurance | 2,900 | 8 |

| One day van insurance | 1,900 | 9 |

| Short term van insurance | 1,600 | 6 |

| Temp van cover | 880 | 8 |

How does Cuvva compare to its competitors?

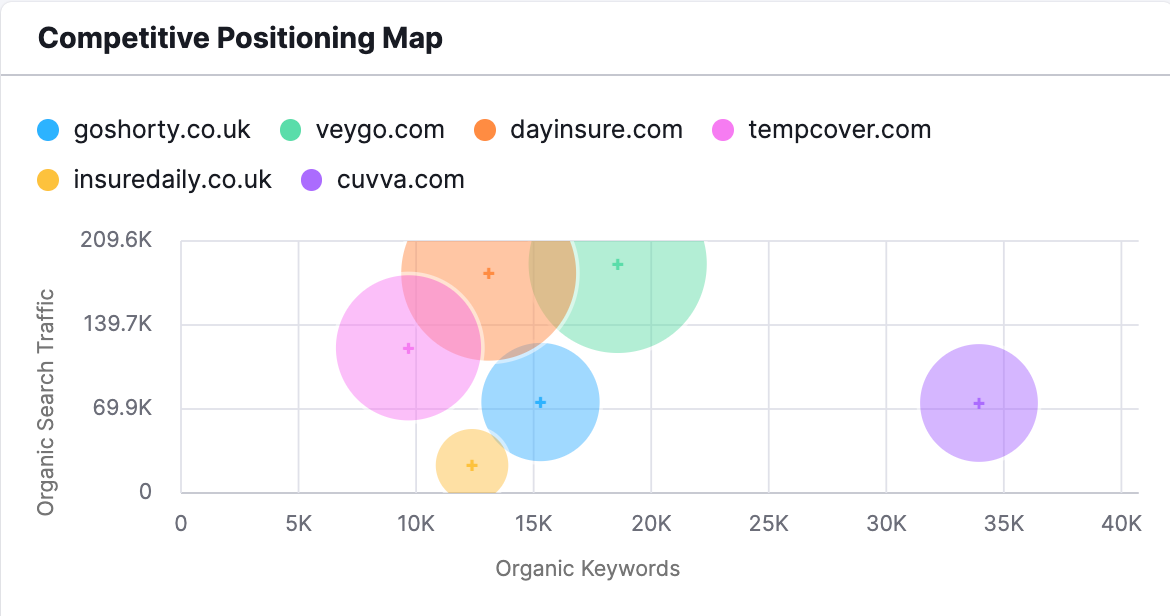

When we turn to the competitive positioning map on Semrush, the narrative becomes clearer. Cuvva ranks for waaaaaaay more keywords than its closest competitors, yet the site is driving significantly less traffic.

In the UK alone, the likes of Veygo, Dayinsure, and Temp Cover all see between 120,000 and 190,000 organic sessions each month…compared with Cuvva’s 74,000.

The upshot? There is some serious ground that, with the right strategy in place, Cuvva can claim and begin dominating the temporary vehicle insurance industry.

Accelerating Cuvva’s SEO Success: The Opportunities

So, let’s take a look at the opportunities Cuvva can leverage to drive organic growth across its service offerings. While I have taken a fairly deep dive into the site, this isn’t a complete picture of the SEO opportunities that exist for the brand…but it’s a good place to start.

1. Fixing keyword cannibalisation

Keyword cannibalisation occurs when multiple pages on a single website compete for the same keyword or set of keywords with the same intent on the search engine results pages (SERPs). It’s an issue of intent.

Essentially, your website is competing against itself, potentially diluting your SEO efforts and confusing both search engines and users.

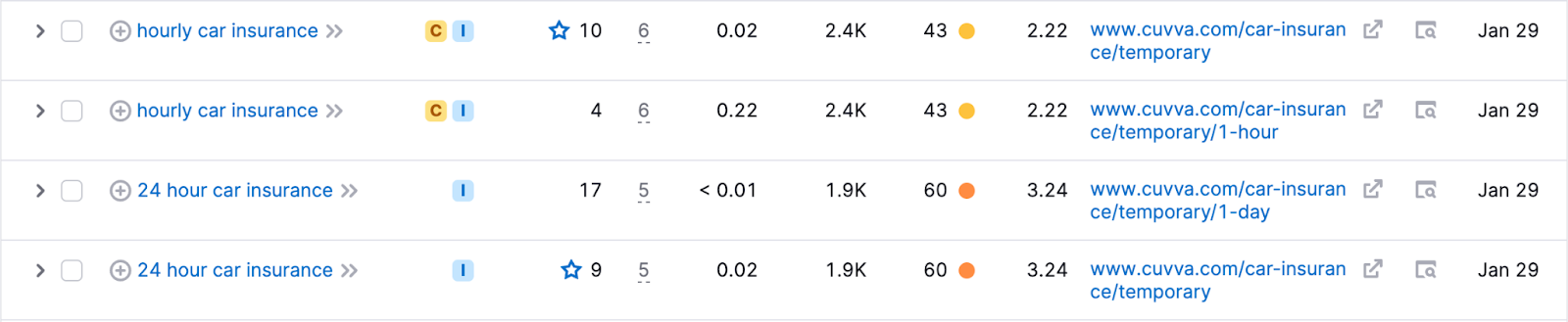

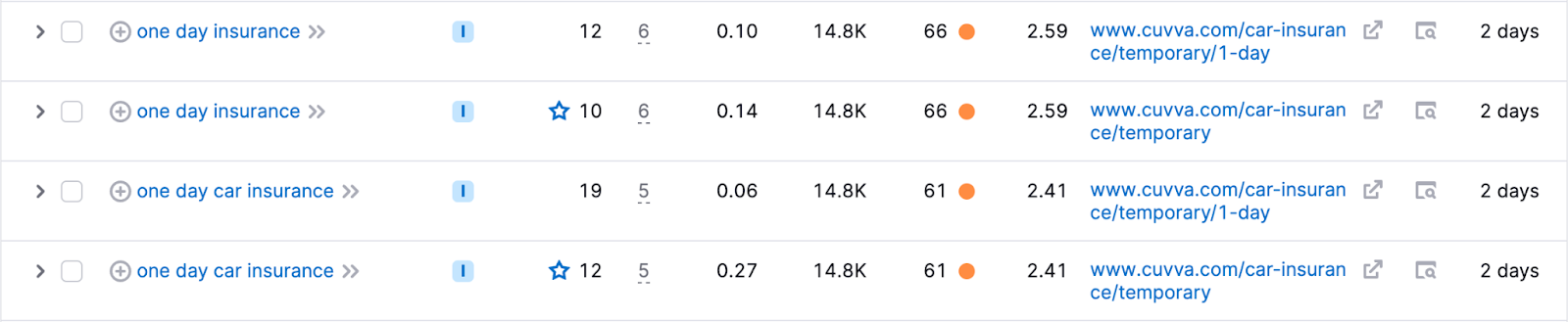

With Cuvva, we can begin to see the extent of this issue by looking at the screenshots below. For high-priority keywords (“hourly car insurance”, “24 hour car insurance”, and “one day car insurance”), Cuvva has multiple pages ranking…neither in traffic-driving positions.

Alone, the four keywords shown below have a combined MSV of 33,900, yet Cuvva is only taking a fraction of the potential traffic.

When we take 2024 Google CTR data from tools such as Smart Insights, if Cuvva were in position 1 or 2 for these search terms, it could be enjoying close to 35% (which, if we’re talking numbers, equates to around 11,800) more clicks every single month.

To tidy things up, Cuvva needs to action a site-wide optimisation strategy.

Instead of having multiple pages all targeting the same keyword, we want to identify a priority page and optimise it effectively. Here’s how…

- Tweaking page metadata to increase and, where needed, decrease the focus on target keywords to reduce mixed signals (for example, the main /temporary page currently has “1-hour” in the title tag)

- Getting smarter with internal linking by doing a site-wide audit of internal links – identifying pages that don’t have many internal links pointing to them and updating anchor text that doesn’t match the focus of the destination page.

2. Optimising to boost low-hanging fruit content

While the ultimate goal is to rank for highly competitive, high-volume keywords, there’s significant value in pursuing low-hanging fruit.

Why is this an opportunity?

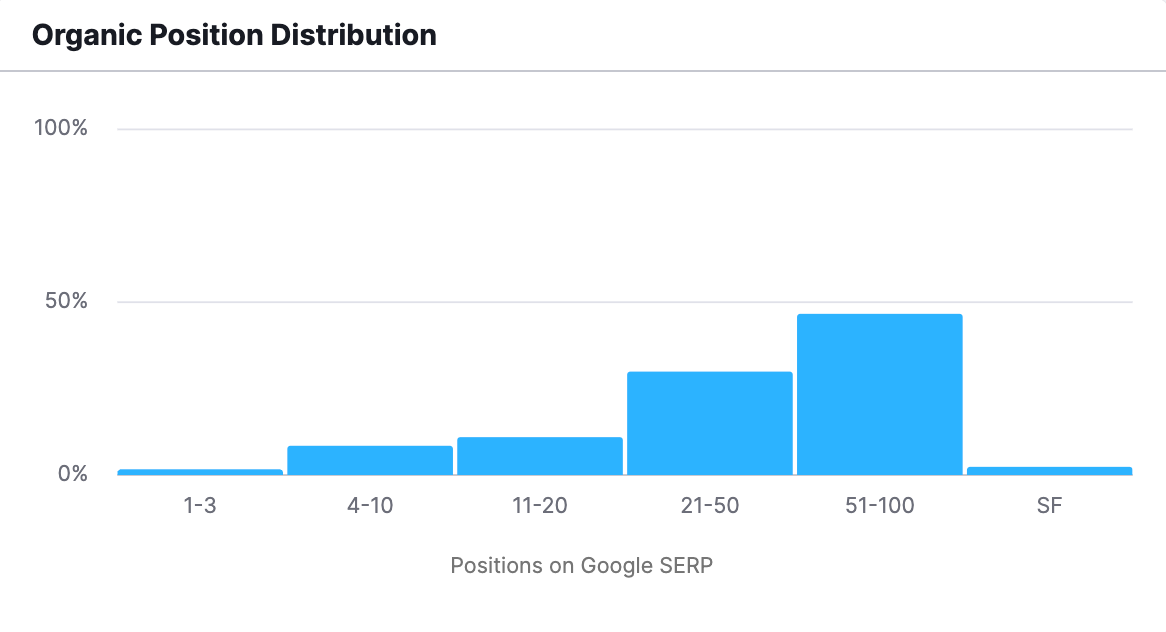

Well, when we refer back to the competitive positioning map, it’s clear that Cuvva’s SEO footprint isn’t having the same traffic-driving impacts as competitors.

Cuvva’s keyword profile is far greater than those of competitors, yet it receives a fraction of the visitors, which is symptomatic of a site with pages that are currently ranking just outside the top 10 positions for relevant terms.

By analysing search data and identifying these opportunities, Cuvva can implement targeted on-page optimisations (improving content, tweaking metadata, strengthening internal linking, adding multimedia, etc.) to push those pages over the top and capture incremental traffic gains with relatively low effort.

Who can turn down a string of quick wins, right?

Here’s a sample of the keywords and target pages I’m talking about…

| Page | Keyword (position) | Quick wins |

|---|---|---|

| www.cuvva.com/insurance-groups | Insurance groups (14) | The ranking page is an insurance group checker tool, but the SERPs show informational blog posts explaining vehicle insurance groups in detail. To rank in a traffic-driving position for this query, Cuvva needs to create a standalone blog targeting the explanatory intent. |

| www.cuvva.com/how-insurance-works/understanding-impounded-car-insurance | Impound insurance (16) | For this query, Google is rewarding pages that cater for more of a commercial search intent. Looking at the SERPs, we can see product landing pages where users can send an enquiry to take out an impound insurance policy. If possible, Cuvva should create a similar landing page for this product |

| www.cuvva.com/car-insurance/temporary/1-day | One day insurance (13) | Currently, there are cannibalisation issues with the ‘1-day’ and ‘temporary’ pages. This means Cuvva isn’t ranking in a meaningful position for queries specific to one-day car insurance. To resolve, we need to employ the re- and de-optimisation tactics outlined in opportunity #1. |

| www.cuvva.com/car-insurance/learner-driver | Provisional driver insurance (13) | The current ranking page is solely optimised for queries relating to learner driver insurance, but it could rank for a broader range of keywords with semantic relevance. By including an H2 with the phrase “provisional driver insurance” and mentioning this KW several times throughout the body copy, Cuvva will increase its chances of securing visibility on these SERPs. |

3. Elevate E-E-A-T signals at content, author, and brand levels

Like it or not, E-E-A-T is here to stay, and brands must showcase all of its constituent components if they want to perform well on SERPs.

For brands operating in YMYL fields, E-E-A-T is of special importance. The insurance world is basically one gigantic trust exercise, which means E-E-A-T signals are make-or-break.

As it stands, blog posts and guides don’t have author bios or credentials. A rookie mistake, considering you’re dealing with complex financial topics that demand a heavy dose of credibility. Faceless content just ain’t gonna cut it.

Cuvva needs to bring some star power to the stage by showcasing its internal experts and outside industry authorities through dedicated author pages, schema markup, and unique insights layered into the content itself.

Here’s an example of what the person schema could look like for one of Cuvva’s expert authors…

And with the fallout from the recent Google API leak, credible authorship has never been more important for brands wanting to perform on SERPs. Now, we have verified intel that Google can (and, let’s face it, probably does) use author trust signals to directly inform ranking potential.

4. Shifting the supporting content strategy up a gear

After a period of impressive growth post-launch, Cuvva’s visibility for non-brained keywords in the /how-insurance-works subfolder has seen a steady decline. In March 2022, organic traffic reached a high of 126,000 sessions, but fast-forward two years, and this figure stands at 76,000.

To begin rebuilding this non-branded footprint across a diverse range of relevant queries, we need to do a deep dive into the keyword gap that exists between Cuvva and SERP competitors. We need to ask questions like:

- What are comparable temporary vehicle insurance providers ranking for?

- What queries are returning the biggest bang for their buck?

- What keywords has Cuvva lost visibility for over the past 18-ish months?

Then, taking these insights, Cuvva needs to recalibrate its supporting content in reference to a full-funnel strategy. By making sure that there is high-quality content for each stage in the buying journey – from initial awareness to conversion and beyond – the brand can nurture users gently but purposefully to the point of purchase.

The benefits of a rock-solid supporting content strategy extend far beyond non-branded visibility, though. Having a wealth of carefully curated, calculated content on Cuvva’s site will establish robust topical authority, which, in turn, will further support the ranking potential of core money-maker pages.

Here are some new supporting content ideas* on the house…

- X common mistakes people make on their driving theory test

- On-street parking: What are the rules in the UK?

- Motorway signage: A complete guide for UK drivers

- X tips for driving abroad: What to expect from your first time in a left-hand-drive car

- What are nearside and offside in cars?

- Car insurance cover notes: What are they, and do you need one?

- What cars are the cheapest to insure?

- Can you drive other cars on your insurance policy?

*At present, one or more of Cuvva’s main competitors are ranking in the top 10 positions for queries related to these topics.

5. Improving the site’s navigation and URL structure

When we look at competitor sites, the main navigation menus are far larger and more logical than Cuvva’s.

I mean, Cuvva’s nav isn’t awful. It’s just not great.

And in today’s search landscape, where Google continually raises the bar in terms of user experience standards, anything less than amazing just won’t cut the mustard.

The solution? Reworking the site structure and hierarchy through the lens of keyword research and user intent, implementing tried and tested tactics such as:

- Grouping pages into tightly-themed content silos that focus on a core insurance product/policy type.

- Within those silos, creating logical parent > child taxonomies that reinforce relevance for related terms.

- Leveraging descriptive, consistent URL paths with breadcrumb navigation to enhance crawlability.

- Implementing internal linking across the site, focusing on the product landing pages primarily to boost contextual signals.

- Resolving click-depth issues so no page is more than three clicks away from the homepage.

A refreshed navigation will also allow Cuvva to include the new product pages (identified via keyword research and content gap analysis) in ultra-visible positions on the site.

6. Keyword gaps with landing pages (going granular)

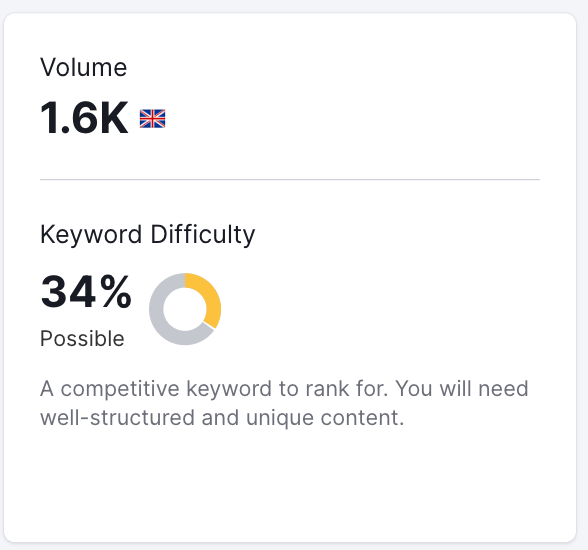

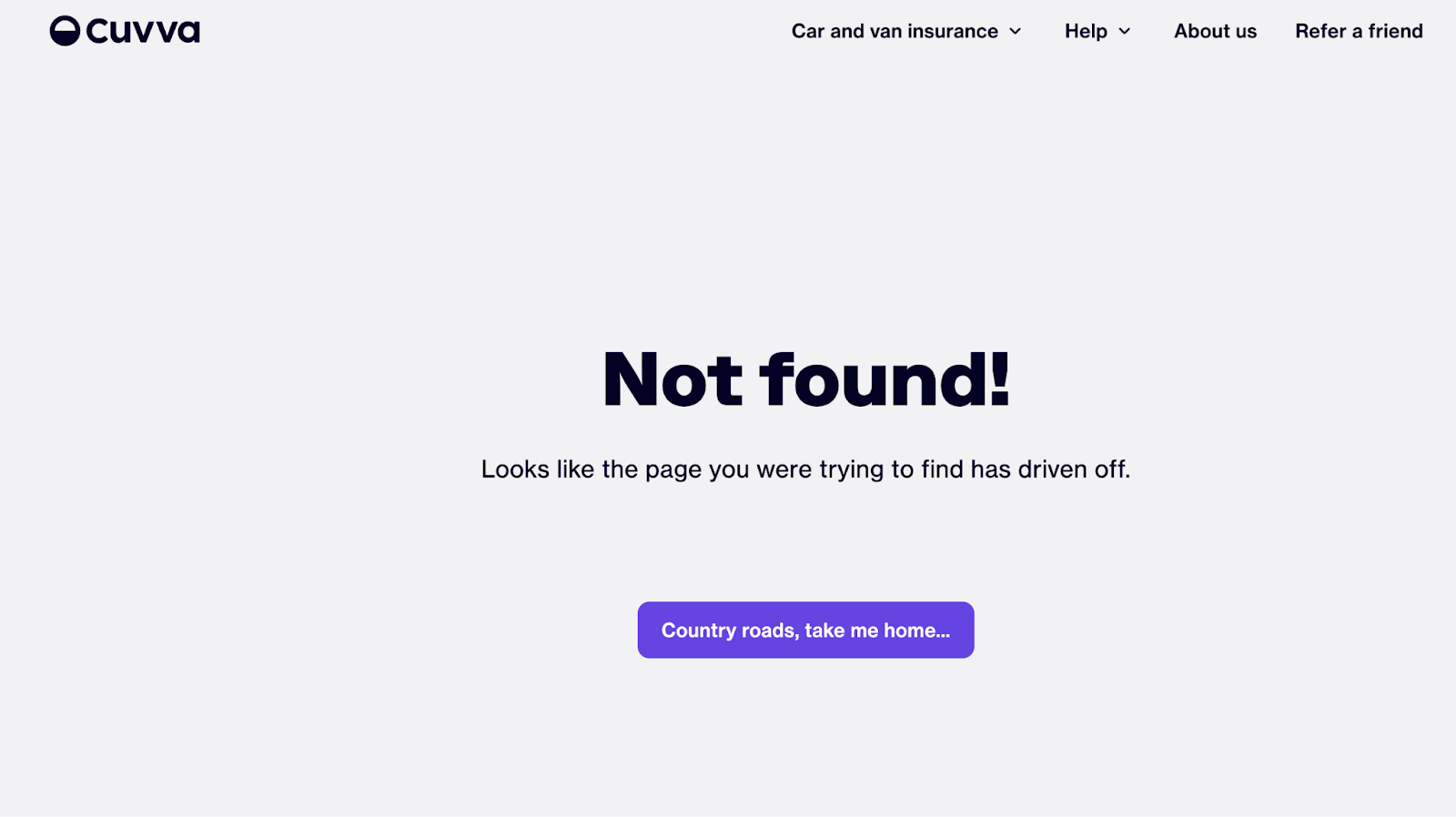

Let’s say you’re one of the ~1.6k people per month who go online looking for “one day van insurance”. Where do you go on the Cuvva site to find what you need?

Here’s where. Cue the sat nav instructions telling you to “make a U-turn when possible”.

Now, in truth, Cuvva is ranking for queries relating to 1-day van insurance…it’s just not ranking well.

Why? Because competitor sites go far more granular with their commercial pages, having dedicated landing pages for specific queries such as weekly van insurance, monthly van insurance, weekly car insurance, new driver temporary insurance, and so on.

So, what does closing that keyword gap actually look like in practice?

First comes running a meticulous keyword gap analysis comparing Cuvva against those top competitors across the entire shared target landscape for commercial queries.

This will surface high-opportunity phrases and keywords that competitor sites are winning on that Cuvva hasn’t even tapped into yet (if only there was a newsletter dedicated to untapped potential).

The next step is a qualitative analysis of the available opportunities – sorting that big list of potential targets based on factors like commercial intent, search volumes, ranking difficulty, relevance to Cuvva’s product/service model, estimated traffic value, and more.

From there, we can prioritise the attack, making sure every ounce of effort has the greatest possible impact – aggressively closing the visibility deficit and taking high-intent traffic away from competitors.

7. Improving on-page UX

These days, just checking off technical SEO boxes isn’t going to cut it. As a user-centric brand, Cuvva needs to be hyper-focused on delivering a kickass page experience that delights visitors and keeps them engaged.

For starters, we need to think about Core Web Vitals.

Google has confirmed that its ranking systems use data on a website’s page speed, mobile compatibility, accessibility, and responsiveness to determine its rankworthiness.

And right now, Cuvva’s vital signs need medical attention.

Considering the brand wants people to convert via its mobile application, the usability stats for mobile devices show serious room for improvement.

I’m talking about an FCP of 6.1s…a TBT of 9,250ms…not exactly podium-topping speeds.

So what’s the fix? Let’s take a look at tactics Cuvva can use to turn things around.

- Image optimisation → Many of Cuvva’s images are in .jpg format, which weighs the site down and increases page load times. Instead, implement lazy loading and convert images to WebP.

- Streamline JavaScript → A simple run through PageSpeed Insights shows a large amount of unnecessary JavaScript. Remove any that isn’t page-critical to reduce evaluation and execution time.

- Mobile-first browsing → Implement a mobile-first design philosophy that prioritises functionality for mobile users. A quick-ish win on this front would be to improve the navigation buttons – make sure they’re visible, clickable, and separate from text-based internal links.

But improving UX means more than just getting the green light on hard performance metrics.

It means considering things holistically and asking critical questions about whether a user will genuinely feel satisfied while interacting with a site.

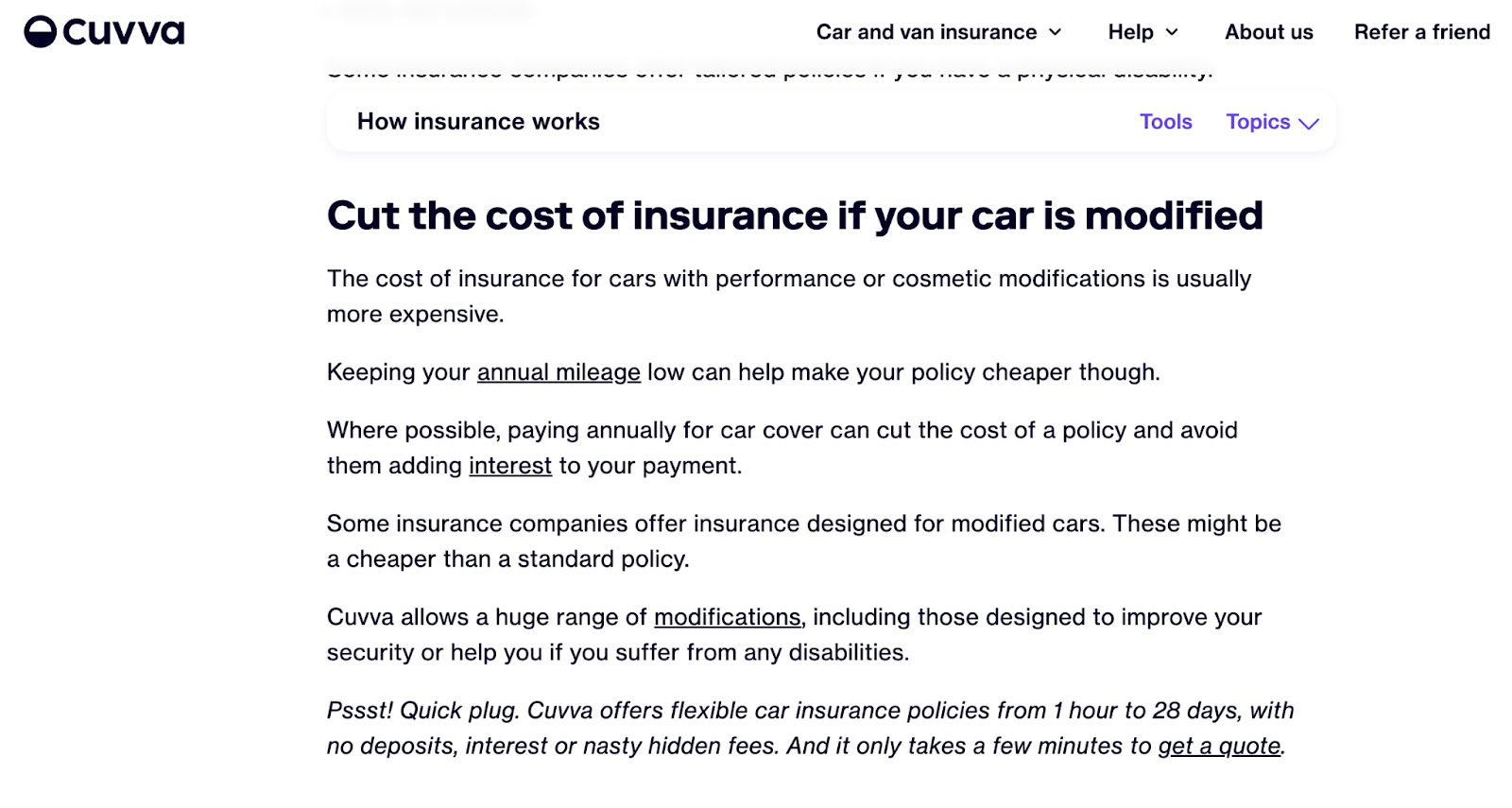

When we look at the Cuvva site, we can see that many supporting pages (blogs, “how it works” posts, etc.) use the same stock images and include CTAs that blend into the background.

But, with a change as simple as the one I’ve suggested below (picture on the right), I bet we’d see conversions soar.

8. Building up the site’s backlink profile

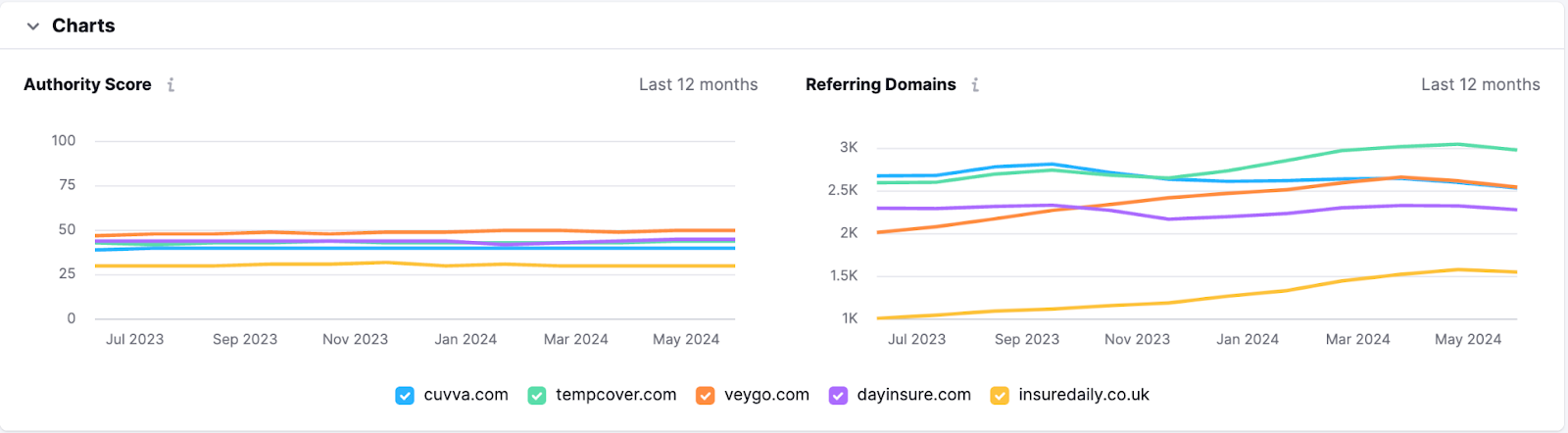

Last but not least, we came to Cuvva’s backlink profile. A robust SEO strategy for the Cuvva site must include initiatives to actively build a strong, diversified backlink profile through high-quality earned media and digital PR.

This will help close the gap between Cuvva and its direct competitors, many of which have seen steady growth in the number of referring domains over the past 12 months.

When we compare Cuvva to Veygo, Tempcover, and even InsureDaily (which have seen the largest YoY percentage growth by a country mile), it’s easy to see that competitors are hard at work securing media coverage for their sites.

If things continue along these trajectories, what will the graphs look like in 6, 12, or 18 months from now?

This needs to involve tactics like:

- Newsjacking and reactive commentary on relevant industry news and trends

- Developing data-driven research studies and visualisations to earn links from publishers

- Leveraging existing customer case studies or creating linkable asset content (tools, calculators, etc.)

By strategically executing a multi-faceted digital PR campaign, Cuvva can acquire authoritative editorial links that boost the website’s off-page authority and improve rankings across target keywords.

Opportunities are there for the taking

What’s clear is this: while Cuvva does enjoy impressive results across many organic metrics, there are areas where the brand could be doing so much more.

With the recent rollout of Google updates (the Helpful Content and Spam Updates, in particular), websites can no longer afford to settle for so-so.

The bars are higher, the goalposts have been readjusted, and publishers must recalibrate their approaches to SEO, backlink acquisition, and content creation if they’re to retain visibility.

But, by implementing a combination of quick-win optimisations alongside more calculated on-page and off-site tactics, Cuvva could really start moving that needle.

With the opportunities well within reach…will Cuvva make 2024 the year it takes pole position?